Symbol copyright Getty Images

Symbol copyright Getty Images

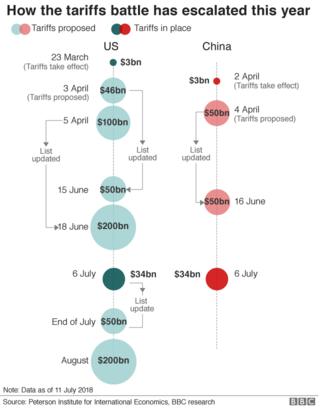

US President Donald Trump says he’s able to intensify his industry struggle with China by slapping tariffs on all $500bn of imports from the rustic.

“I Am ready to go to 500,” he mentioned in an interview with the CNBC channel.

Mr Trump’s comments come prior to probably the most contemporary round of us tariffs has had time to take effect.

Last week, Washington indexed $200bn (£150bn) price of extra Chinese Language products it intends to place price lists on as soon as September.

The listing named greater than 6,000 items together with food merchandise, minerals and shopper goods corresponding to purses, to be topic to a 10% tariff.

Image Copyright @realDonaldTrump @realDonaldTrump

Image Copyright @realDonaldTrump @realDonaldTrump

The U.s. additionally wants China to prevent practices that allegedly encourage transfer of intellectual assets – design and product ideas – to Chinese corporations, corresponding to necessities that overseas companies share ownership with local companions to access the Chinese Language marketplace.

Mr Trump has up to now hinted at such an escalation, telling newshounds two weeks ago that there has been “$300bn in abeyance” after the $200bn of products coated through the latest record, however this is his most specific threat yet.

Many corporations within the US are against the administration’s use of price lists against China, announcing they chance hurting industry and the financial system with out being likely to modification behaviour.

European inventory markets fell after the interview was once broadcast, with the FTSE 100 down 0.4% in afternoon industry.

“It Is proof, if it have been wanted, that the president is ready to move the entire manner within the industry warfare to actual concessions from China, which merely can not match the united states firepower,” stated Neil Wilson, leader market analyst for Markets.com.

“In gentle of the european and others pronouncing they’re able to reply to tariffs on cars, the stakes are rising rapid. Whether we get to the point the place there may be a whole-blown industry struggle remains debatable, however the odds are shortening by the day.”