Image copyright Getty Pictures Image caption Foreign Exchange values are displayed in Buenos Aires, on August 29, 2018.

Image copyright Getty Pictures Image caption Foreign Exchange values are displayed in Buenos Aires, on August 29, 2018.

Argentina’s significant bank has raised interest rates to 60% as the price of the peso endured to plummet.

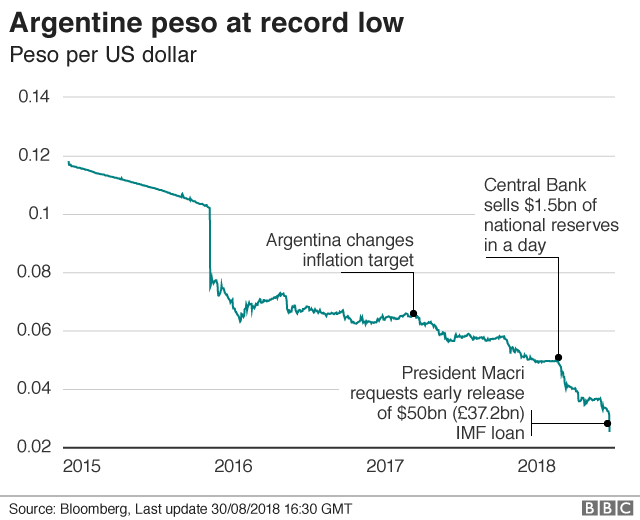

The foreign money plunged by means of nearly 15% on Thursday, after falling through more than 7% a day earlier.

The fall got here after the World Monetary Fund (IMF) agreed to speed up its $50bn bailout to the country, citing “more opposed” marketplace conditions.

The move heightened investor fears approximately the country’s economy.

Argentina’s significant financial institution mentioned Thursday’s fee hike, from FORTY FIVE% to 60%, was once a “reaction to the foreign currency charge situation and the danger of greater inflation”.

It had already increased interest rates 4 occasions on the grounds that April, such a lot not too long ago on 13 August.

Those actions had been induced through the unexpected weakening of the peso in April as a drought hurt farm exports, power prices climbed and a stronger buck led traders to drag funds from rising markets.

In Would Possibly, while Argentina sought the bailout from the IMF, President Mauricio Macri solid the request as a precautionary measure.

Since then, however, the commercial turmoil has persisted.

The peso has now fallen through more than 50% towards the greenback this yr.

Marketplace doubts

By Way Of Daniel Gallas, South The Us Business Correspondent

Interest Rates of FORTY% already seemed like a bold thought back in Might, while Argentina attempted to prevent a first run on its forex.

Taking it now to 60% seems virtually surreal.

Getting 60% returns on loans looks as if an improbable trade probability in any a part of the world.

However not if investors imagine the peso would possibly not be value much a yr from now, that’s what’s triggering the present devaluation.

Ultimately there may be a scarcity of trust in the executive’s skill to do the reforms it promised the IMF.

The IMF’s director common continues to be sticking to Mr. Macri’s plan. But markets don’t seem to be going at the side of them.

The inflation price is working at greater than 30%, partially as a result of the federal government elevating prices on fuel and electrical energy because it tries to repair its finances.

The adjustments have made daily life dearer, inflicting families to scale back spending and contributing to a 6.7% slowdown within the economic system in June.

Symbol copyright AFP

Symbol copyright AFP

however the IMF stated closing month it expects Argentina’s economic system to stabilise by means of the end of the 12 months and a steady restoration to begin in 2019.

Argentina is within the middle of a pro-marketplace economic reform programme, as Mr Macri seeks to reverse years of protectionism and top government spending beneath his predecessor, Cristina Fernandez de Kirchner.

He faces rising political opposition as a result of issues approximately austerity measures.

His turn to the IMF used to be also surprising because the supplier continues to be unpopular in Argentina because of the industrial problems related to earlier help.