Image copyright Getty Images Symbol caption Greater Than eight years of brutal cuts ended in anger at both Greek leaders and Ecu lenders

Image copyright Getty Images Symbol caption Greater Than eight years of brutal cuts ended in anger at both Greek leaders and Ecu lenders

On Monday, Greece ends its 3rd and final financial bailout programme, having won greater than €300bn (£269bn; $342bn) over eight years.

the federal government and its European lenders are prepared to paint the top of the ultimate bailout as a fair factor, having have shyed away from a “Grexit” during which the country could have crashed out of the eurozone into unknown territory.

But for plenty of Greeks – particularly the younger – the wear and tear has already been done.

A latest poll indicates that 3-quarters of the inhabitants assume the rustic is headed down the inaccurate trail. the same number suppose the bailout deals, in preference to saving Greece, in fact harmed the rustic.

Taxes remain high and greater than 90% of Greeks consider the creditors will stay an in depth watch on the rustic’s spending for years.

“individuals are persuaded, and rightly so, that austerity insurance policies will continue for the years to come back,” says Dr Vasilis Leontitsis, a lecturer in Globalisation Studies on the College of Brighton.

Back in 2011, Mr Leontitsis wrote a weblog put up a couple of “lost generation”, and a young Greek lady he met in Athens. She was once considered one of the lucky few with job in a café.

“i do know that i’m going to have a difficult long term,” she informed him. “My pals and i have stopped planning… because regardless of how so much we plan, not anything is to materialise.”

How bad are issues for the Greeks? What has austerity done for the eurozone?

Mr Leontitsis says he’s adopted her growth in view that.

She was excited to get a promising process in on-line gross sales, but the company’s terrible efficiency supposed she misplaced that within six months. Due To The Fact then, she has only secured an element-time task in a packaging company – counting on her family to make ends meet.

“When I wrote approximately Greece’s lost technology, I meant exactly this,” Mr Leontitsis says.

“Young people are disenchanted regarding activity prospects in Greece. Ratings of teens – among them many skilled – have left the country aiming for a greater long run in different EUROPEAN nations and past.”

Nowadays, he says, “the typical fact of the country’s early life remains extraordinarily precarious”.

How did Greece get right here?

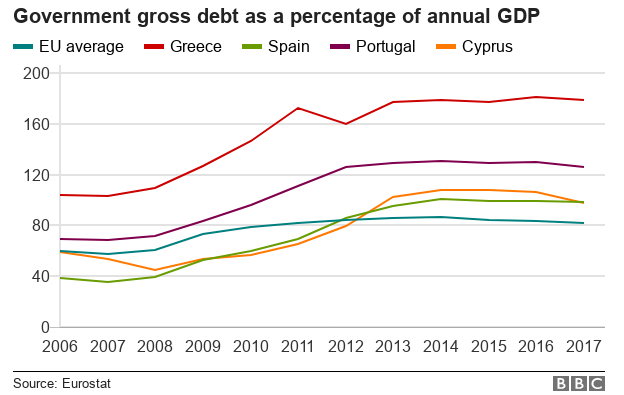

the global monetary crisis began to in reality hit the eurozone after 2008. Eire, Spain, Portugal and Cyprus every wanted bailout loans to stay afloat. However things had been worse in Greece.

All Greek to you? Debt jargon explained The Greek debt challenge story in numbers

In late 2009, it emerged that Greece’s nationwide finances deficit – or annual debt – used to be greater than 10% of the country’s whole economy (GDP).

By Means Of the tip of the 12 months, credit standing businesses had downgraded Greece’s standing, making it more difficult for Greece to borrow.

But the actual scale of the Greek downside was worse than it first seemed.

The Eu records agency had raised considerations approximately Greece’s economic estimates years in advance. Then, in 2010, it emerged that the monetary data were misreported. Earlier numbers needed to be revised upwards and trust in Greek information was shattered.

Tax evasion used to be rampant and Greece used to be rated essentially the most corrupt country within the EU in 2012.

Something had to be done.

within the first part of 2010, the federal government brought in sweeping austerity applications, reducing public pay and raising taxes. nevertheless it nonetheless wasn’t enough.

Symbol copyright Getty Photographs Symbol caption In 2010, the primary wave of austerity measures caused protests and violent clashes in Athens

Symbol copyright Getty Photographs Symbol caption In 2010, the primary wave of austerity measures caused protests and violent clashes in Athens

Through Might, an almost bankrupt Greek country struck a deal with the so-called “Troika” – the ecu, Ecu Imperative Bank and World Financial Fund – none of which wanted to see Greece default on its debt, fearing a knock-on impact on other nations.

This used to be the primary bailout – a loan of €110bn. however it got here with a situation: much more price range cuts.

Violent protest

Street protests broke out towards the stern austerity measures, eventually turning violent, and even leading to a handful of deaths.

Symbol copyright Getty Photographs Image caption In Athens, February 2012 – hearth bombs are thrown within the streets

Symbol copyright Getty Photographs Image caption In Athens, February 2012 – hearth bombs are thrown within the streets

The unrest continued, at the same time as Greece’s credit standing was downgraded to “junk” status. More austerity followed the following year, and unemployment began to rocket.

In 2011, the second bailout was agreed, this time for €109bn, later revised upwards to €130bn.

Protests persisted, and in politics, anti-austerity events promising to reject spending cuts began making profits. Formative Years unemployment peaked in 2013 at virtually 60%.

Anti-EUROPEAN sentiment was displayed at many protests – from the burning of the ecu flag to signs about Greece being a “colony” of German Chancellor Angela Merkel.

In December 2014, the beleaguered Greek govt in any case collapsed.

Symbol copyright Getty Photographs Image caption 2012: Supporters of the quickly-to-be PM Samaras rally in Athens – he lasted not up to three years

Symbol copyright Getty Photographs Image caption 2012: Supporters of the quickly-to-be PM Samaras rally in Athens – he lasted not up to three years

In its place, the anti-austerity, left-wing Syriza celebration gained its first nationwide victory.

2015: Radical left takes energy in Greece Third Greece bailout: What are eurozone conditions?

“Syriza quickly realised it needed to adopt austerity policies as prescribed by the Troika,” Mr Leontitsis says. “The political and economic revolution it had estimated on paper by no means materialised.”

“not just did Syriza alongside its coalition partner deal with austerity policies, but in many circumstances it bolstered them.”

Greece ended up desiring a third bailout – even though, in a referendum organised through Syriza, a majority of Greeks rejected it.

2015 was once a tumultuous summer: banks closed, cash withdrawals have been restricted, and the Greek stock trade closed for the month of July.

Symbol copyright Getty Pictures Image caption The summer time of 2015 – ahead of the 3rd bailout – saw its own percentage of unrest

Symbol copyright Getty Pictures Image caption The summer time of 2015 – ahead of the 3rd bailout – saw its own percentage of unrest

the federal government eventually agreed the 3rd bailout of €86bn in August.

Now, 3 years later, that 3rd and ultimate programme of loans to Greece is finishing. however the results may well be felt for decades.

Hopes for the long term

Giorgios Christides’ priorities have changed seeing that 2012, whilst he advised the BBC his pals had been leaving. Now he is involved for his youngsters, elderly five and 11.

“i am wary about their future here,” he says. “Mavens warn it’ll take years or a long time for Greece just to go back to the pre-hindrance prosperity ranges.

“which is why folks like me try, to the best of our talents, to provide our kids with the skills and information that may help them get an education and land a role in a foreign country – if want be.”

but the Greek other people have large doable, he says.

“i am no longer giving up… i believe it’s our duty to no less than attempt to make it here, prior to calling it quits and moving out of the country.”