Image copyright Getty Photographs Symbol caption A employee exams wind turbine blades at a factory in Lianyungang, Jiangsu province

Image copyright Getty Photographs Symbol caption A employee exams wind turbine blades at a factory in Lianyungang, Jiangsu province

The United States and China are expected to impose recent price lists on $16bn (£12.4bn) of each other’s items on Thursday as their tit-for-tat industry struggle rages on.

The 2nd spherical of price lists will see a complete of $50bn value of goods from both sides so we can now be taxed.

Since the outlet salvo in July, tensions among the world’s two greatest economies have escalated, hurting their companies and economies.

The tariffs come into effect as officials meet for talks in Washington.

They are because of wrap up days of low-stage industry negotiations on Thursday, but few wish for a breakthrough.

Symbol copyright Getty Photographs Symbol caption President Trump has taken an aggressive stance on trade with China

Symbol copyright Getty Photographs Symbol caption President Trump has taken an aggressive stance on trade with China

Washington’s plan to proceed with the recent round of tariffs comes regardless of testimony to the u.s. Business Representative’s Administrative Center by dozens of yank companies and industry groups that oppose the tax.

Many said the brand new tax might hurt their businesses and warned that they’d no longer be able to soak up any other tax without raising prices for US consumers.

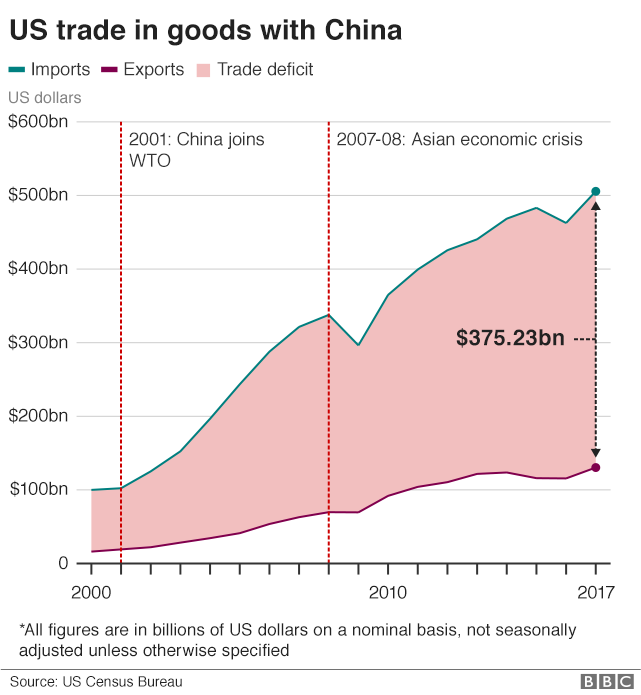

However, the $16bn is a drop in the ocean in comparison to the volume Donald Trump has flagged might be hit with price lists.

The president mentioned in July he was able to tax all of the $500bn price of Chinese imports into the united states.

Round three

The United States has threatened a third round of tariffs on an additional $200bn of Chinese Language goods and they could come as soon as subsequent month.

It has due to the fact stated those merchandise may well be hit with a 25% levy – more than double the 10% at first deliberate.

China has said it might respond with a new tariff on any other $60bn of us goods.

But it might be more difficult for Beijing to check the united states threat because its manufacturers export far more merchandise than American companies send to China.

The United States Trade Representative’s Place Of Business is maintaining hearings this week at the most probably have an effect on of a 3rd round of price lists imposed on Chinese Language items this year.

For its section, China has accused the us of “unilaterally” heightening tensions between the 2 financial giants, and has vowed to retaliate.

Hurting businesses

There are indicators the industry conflict is already having an impact.

Major carmakers lately warned that adjustments to business policies had been hurting efficiency.

Media caption”we have now to be ready for the worst”

The Global Financial Fund mentioned final month an escalation of the tit-for-tat tariffs may just shave 0.5% off global growth via 2020.