Symbol caption Like The Cheshire Cat, it is laborious to tame something that keeps disappearing and reappearing

Symbol caption Like The Cheshire Cat, it is laborious to tame something that keeps disappearing and reappearing

The offshore finance trade puts trillions of dollars around the globe beyond the taxman’s reach. Bringing it to heel is like taming a cat; not just a regular moggy – a thankless process in itself – however a Cheshire Cat: nebulous, arduous to pin down, disappearing and reappearing whilst it likes.

No-possible in truth agree on what a tax haven is. and even on the name: one particular person’s tax haven is any other’s “offshore monetary centre”. No-it is easy to agree on how many there are. Nor on precisely how much money is stashed offshore. No facts are absolutely dependable.

And this fits individuals who operate in offshore finance, from the landlord of the wealth to the legal professional or accountant middlemen who take care of the price range, to the customarily solar-kissed seashores of the jurisdictions where they’re secluded or pass through. The industry’s key word is privacy. Or secrecy – a word it doesn’t like so much.

One adage mentioned by the taxation author and knowledgeable Nicholas Shaxson sums it up: “people who know do not communicate. And individuals who talk do not know.”

However will we in point of fact no longer know how much is stashed offshore?

if you happen to are considering, wow, that is larger than Japan’s economy, you would be proper. but when you need an actual wow, check out $36tn – the estimate introduced by means of James Henry, author of the book Blood Bankers. That’s two times as large because the US economic system.

However no-one in point of fact knows.

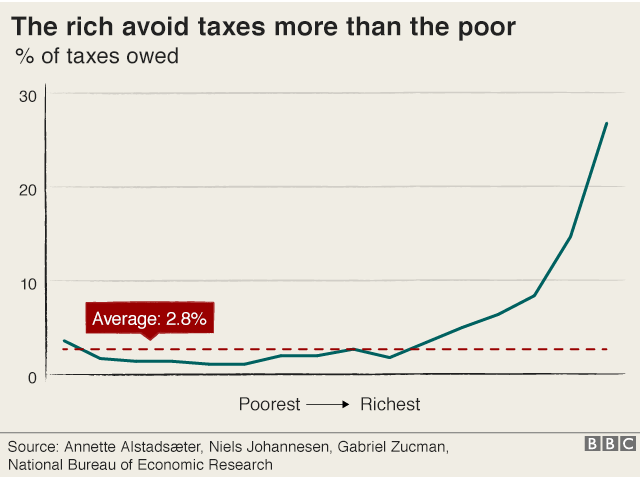

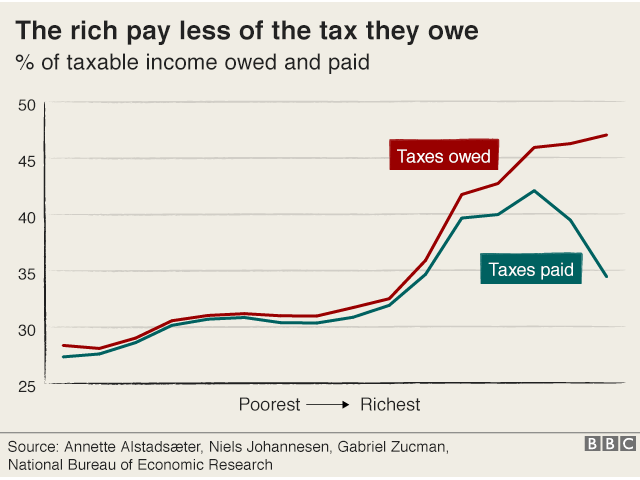

And this is some other wow. Needless To Say the slogan “we are the NINETY NINE%” coined via the Occupy movement to lambast the highest 1% of the population for his or her disproportionate share of wealth? Smartly, the Zucman report says 80% of all offshore cash is owned by 0.1% of the richest households, with 50% held by the top 0.01%.

So when you learn this and are pondering, in the event you cannot beat them… reasonably frankly, it is not going you’ll ever join them. The management charges for the normal individual will most likely far outstrip the gains.

As Nicholas Shaxson advised BBC Panorama: “At The very lowest end you should have the center classes doing little bits and items. however the large majority of what’s going on, this is a game for rich other people.”

Felony, however ethical?

Indubitably we all know a few of how this works? The techniques have a ring of familiarity – double taxation; tax inversion; trusts; shell companies and so on. It’s simply we do not frequently know who is within the schemes and what they’re getting out of them.

The basic essence is rerouting money in a single area the place you do not like the taxation regulations to another location – one that is strong and reliable – where there aren’t as many, or any.

For example, if you wish to protect your belongings to stave off creditors, stick them in an offshore shell corporate. Hi There presto, much more difficult to get at. want to hide possession of a belongings? Placed it in a trust.

This isn’t unlawful. There are many other schemes, legal, unlawful and often ethically debatable. But even inside of those classes there are many variables on what in truth constitutes The Nice, the Unhealthy and the Unpleasant. after all, in the film with that name the ugly arguably wasn’t as bad because the dangerous, and the nice used to be rarely absolute best.

Real to their Cheshire Cat-like origins, offshore financial centres (OFCs) don’t at all times appear where one may expect them.

That’s because offshore, sorry to confuse you, is also onshore. This makes it unimaginable to pin down the global selection of OFCs. it would be 50, 70 or extra and new ones come and cross.

The US and UNITED KINGDOM are arguably two of the most important OFCs.

For instance, putting in place shell firms is easy in a few US states, like Delaware.

And it’s widely recognized that town of London acts because the facilitating hub for Crown dependencies and in a foreign country territories that channel trillions of offshore greenbacks.

The smaller, regularly island, nations are what Nicholas Shaxson calls “captured states”.

Spin backwards to April 2016. The Panama Papers have simply pop out. Iceland’s PM Sigmundur Gunnlaugsson has resigned after the leaks confirmed he owned an offshore corporate along with his wife.

Thousands are demonstrating in Reykjavik to vent anger at their politicians.

Some estimates put the protest numbers at 6% of the entire Icelandic inhabitants. That Is like if 19 million folks grew to become as much as a protest in the united states today.

But then shuttle over to Elektrostal, hours east of Moscow. Resident Nadezhda is haranguing BBC reporter Steve Rosenberg. “A Lot Of These ‘investigations’ are a waste of time and cash. we all know what you might be up to. They’re seeking to rub Putin’s face within the dirt,” she says.

It kind of relies on the place you are.

Symbol copyright Ragnar Hansson Image caption Ragnar Hansson at the Iceland protest

Symbol copyright Ragnar Hansson Image caption Ragnar Hansson at the Iceland protest

in the West, a minimum of, people are questioning what high-web-value people and multinationals can get away with.

Is it right that they may be able to use loopholes to maintain more of their cash? Or must it visit governments to spend on their folks?

To be honest, governments have been monitoring stashed money because the 2008 international meltdown, independent of any monetary leaks, even supposing their communicate has usually been more difficult than their action.

Secrecy is now tougher to achieve, transparency is greater. So-known as usa-via-u . s . a . reporting, requiring multinationals to break down how they perform in numerous international locations, has widened and public registries of businesses have increased.

Even Russia brought in a law requiring the disclosure of offshore assets. the result? since the legislation came in 3 years in the past, dozens of the tremendous-wealthy have given up Russian residency to circumvent it.

There are also OFC blacklists mooted but, as Nicholas Shaxson says, the massive players will make sure their operations are not on it and it’s going to weed out simplest the minnows.

The offshore corporations will “recalibrate”, he says. “When law adjustments, you will have this environment more or less readjusting and the money will shift to other puts.”

And wealth holders will readjust too. Pump money into diamonds and artistic endeavors perhaps? or simply cross and in reality reside somewhere that fees low tax.

What makes this a vicious circle is that many governments are totally ready to sanction offshore finance. Certainly, many of us in government use it, as these leaks show.

And there’s one thing we do realize. If the tremendous rich do not pay the taxes, the cash has to come back from everyone else.

Which to many might sound a bit of mad, but because the Cheshire Cat says: “We’re all mad here”.

The papers are an enormous batch of leaked files most commonly from offshore law company Appleby, at the side of corporate registries in 19 tax jurisdictions, which monitor the monetary dealings of politicians, celebrities, corporate giants and industry leaders.

The 13.4 million records were handed to German newspaper Süddeutsche Zeitung after which shared with the International Consortium of Investigative Reporters (ICIJ). Panorama has led research for the BBC as part of a global research concerning just about ONE HUNDRED other media corporations, together with the Parent, in SIXTY SEVEN nations. The BBC does not understand the identification of the source.

Paradise Papers: Complete protection; follow response on Twitter using #ParadisePapers; in the BBC Information app, apply the tag “Paradise Papers”

Watch Panorama on the BBC iPlayer (UNITED KINGDOM viewers simplest)