Symbol copyright AFP

Symbol copyright AFP

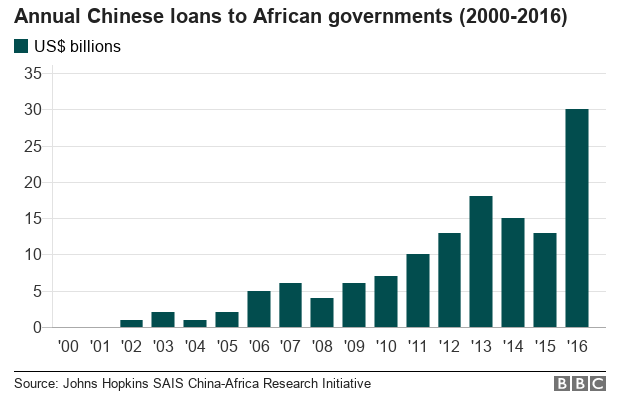

African nations have shown a wholesome urge for food for Chinese loans but a few mavens now worry that the continent is gorging on debt, and could quickly choke.

The Entebbe-Kampala Limited-Access Highway is still one thing of a tourist appeal for Ugandans, just about 3 months after it opened.

The 51km (31 mile), 4-lane highway that connects the country’s capital to the Entebbe International Airport used to be built through a Chinese Language corporate the usage of a $476m (£366m) loan from the China Exim Financial Institution.

It has minimize what was once a torturous -hour journey through some of Africa’s worst visitors into a scenic FORTY FIVE-minute drive into the East Africa nation’s capital.

Image caption the brand new limited-access highway was financed with thousands and thousands of greenbacks from China

Image caption the brand new limited-access highway was financed with thousands and thousands of greenbacks from China

Uganda has taken $3bn of Chinese loans as a part of a much wider trend that Kampala-primarily based economist Ramathan Ggoobi calls its “unrivalled willingness to avail unconditional capital to Africa”.

The Chinese style has many prime-profile defenders at the continent, including the top of the African Building Bank (ADB) Akinwumi Adesina, a former Nigerian agriculture minister.

“so much of people get fearful approximately China however i am no longer. i think China is Africa’s friend,” he told the BBC.

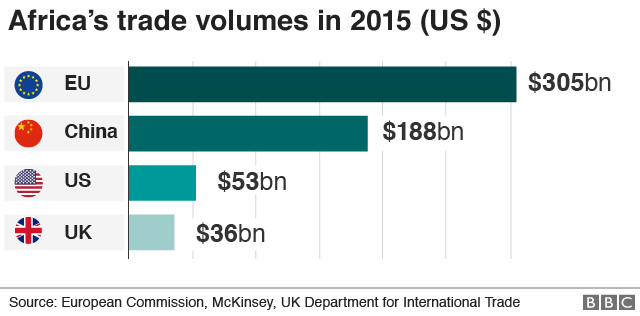

China is now the single largest bilateral financier of infrastructure in Africa, surpassing the ADB, the ecu Commission, the eu Investment Bank, the International Finance Employer, The World Bank and the gang of 8 (G8) international locations mixed.

China – the ‘bigger winner’

The money’s affect is conspicuous far and wide Africa, from glossy new airports and roads in addition as ports and top-rise homes which might be also developing much-wanted jobs.

In truth, a McKinsey and corporate research discovered that the amount of loans Beijing had made to Africa had tripled considering the fact that 2012, together with an outsize $19bn to Angola on my own in 2015 and 2016.

It pointed out Angola and Zambia as unbalanced companions with China in Africa.

Symbol caption China’s investment in Zambia has been arguable

Symbol caption China’s investment in Zambia has been arguable

“In Angola’s case, the government has supplied oil to China in alternate for Chinese Language financing and building of best infrastructure initiatives – but marketplace driven personal funding by means of Chinese companies has been limited when compared with other African nations,” the company mentioned.

Africa has made vital new gains in business, funding and financing arrangements with China, says Ghanaian investment analyst Michael Kottoh.

“There are several really win-win deals African international locations have closed with out the typical onerous stipulations related historically with doing industry with western countries,” says Mr Kottoh, whose advisory company Konfidants counsels global purchasers.

“But there’s a way in which China is clearly the larger winner – simply because it has the higher leverage in so much negotiations.”

McKinsey initiatives that revenues for Chinese Language companies in Africa could hit $440bn by means of 2025.

Even Mr Adesina agreed that: “the problem that i’ve seen is the asymmetry of energy in the negotiations of the transactions, the place you might be actually giving your mining rights away simply because you need to construct a superhighway.

“you are most effective dealing with one united states, how are you certain that you’re getting the most productive deal?”

‘Sour grapes’

China doesn’t have a Overseas Corrupt Practices Act just like the U.s., or similar legislation in other Western countries that criminalise bribes paid out of the country in alternate for contracts.

although Nobel Prize-profitable economist Joseph Stiglitz calls the Western grievance of China’s work in Africa “bitter grapes,” he admits that there are corruption considerations.

“Each And Every mission whether or not it comes from the west or China needs to be evaluated in opposition to the speed of returns,” he advised the BBC in Nairobi however brought that it was once up to the continent’s governments to be more transparent.

Read extra approximately China in Africa:

Seven surprising numbers from China-Africa business Can Chinese migrants integrate in Africa? What China hopes to achieve with first peacekeeping project

Mr Ggoobi additionally says there are better considerations over the environmental results of Chinese investments, “specifically given the negative, weak, corrupt regulatory institutional infrastructure in Africa”.

In 2015, the China Africa Analysis Initiative on the Johns Hopkins Faculty of Complex World Research sounded alarm bells that African nations may well be not able to pay off Chinese Language loans “as a result of fluctuating commodity costs and reducing absorptive capacity”.

“We Find that Chinese loans aren’t recently a massive contributor to debt distress in Africa,” they now say in a brand new briefing paper sooner than the 7th Forum on China Africa Cooperation Summit this week in Beijing.

China has the lion’s proportion of African debt but the nations are borrowing from many other resources across the world so it’s now not single-handedly guilty for indebtedness.

While the summit final met, in Johannesburg, China promised $35bn in concessional foreign help loans amongst other credit score lines to Africa.

What has not advanced is what Traditional Bank calls a “important business deficit with China” in view that 2014. It says simplest 5 African international locations have a business surplus with China.

Mr Ggoobi desires China to assist Africa construct institutional capability to draw and host practicable investments the use of avenues like different economic zones and business parks to shore up the continent’s export-focused manufacturing.

Symbol copyright AFP Symbol caption African leaders meet yearly in the Chinese funded $200m headquarters in Ethiopia

Symbol copyright AFP Symbol caption African leaders meet yearly in the Chinese funded $200m headquarters in Ethiopia

Up To Now, China has simplest paid lip service to such long-term improve that would wean African nations off their dependency at the Asian tiger.

Djibouti closing month introduced the first segment of the Chinese-built free business zone billed as Africa’s biggest however it’s observed as simply any other piece of the jigsaw puzzle as China revives antique industry routes in its Belt and Road Initiative which goals 60 international locations.

Ugandans might enjoy soaring above the swampy Nambigirwa Bridge on their new throughway, but there are real fears that they might end up drowning in Chinese Language debt.