Image copyright Getty Pictures

Image copyright Getty Pictures

UNITED KINGDOM wages rose extra slowly within the three months to Would Possibly, in spite of a further fall in unemployment, reliable figures show.

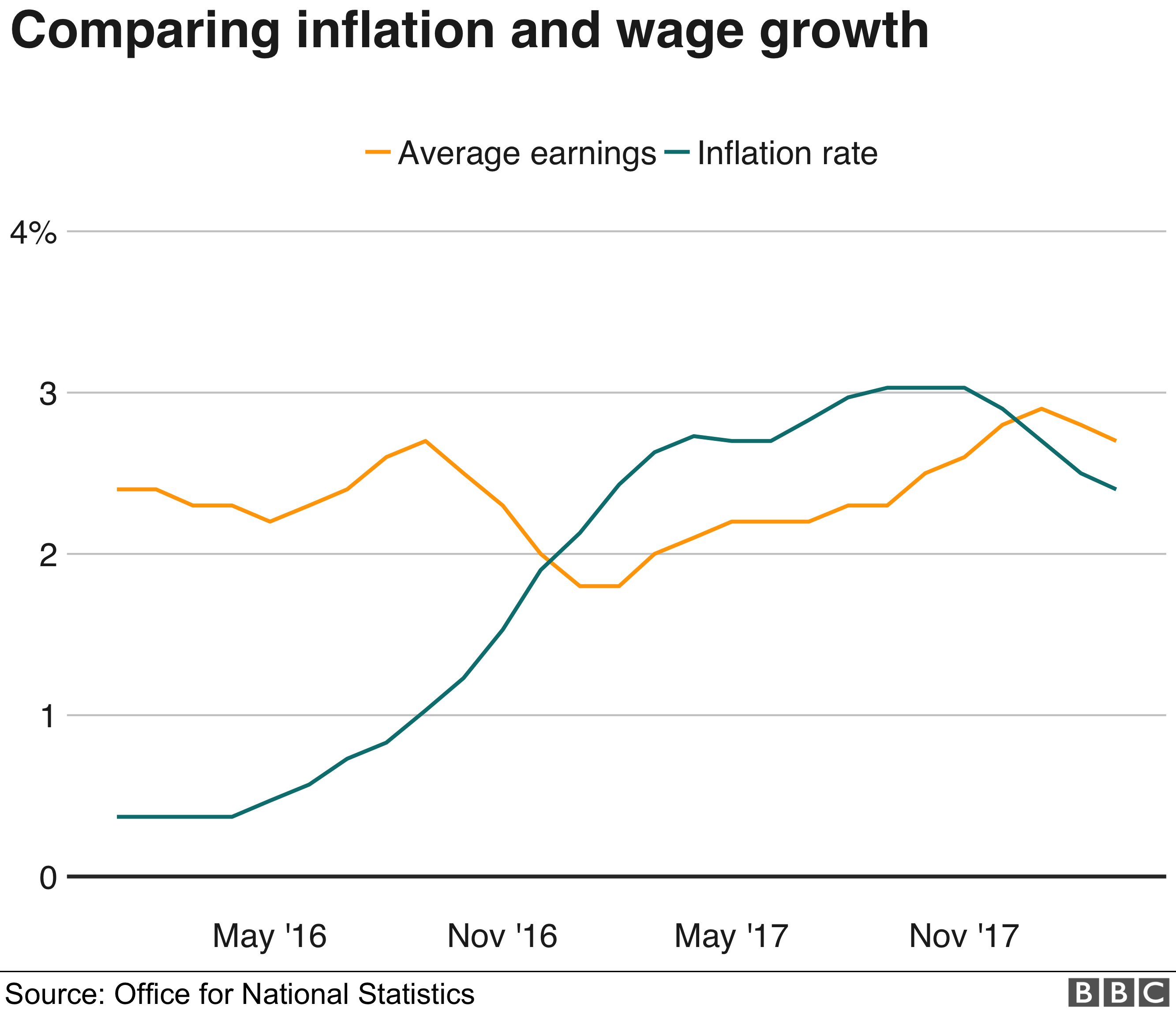

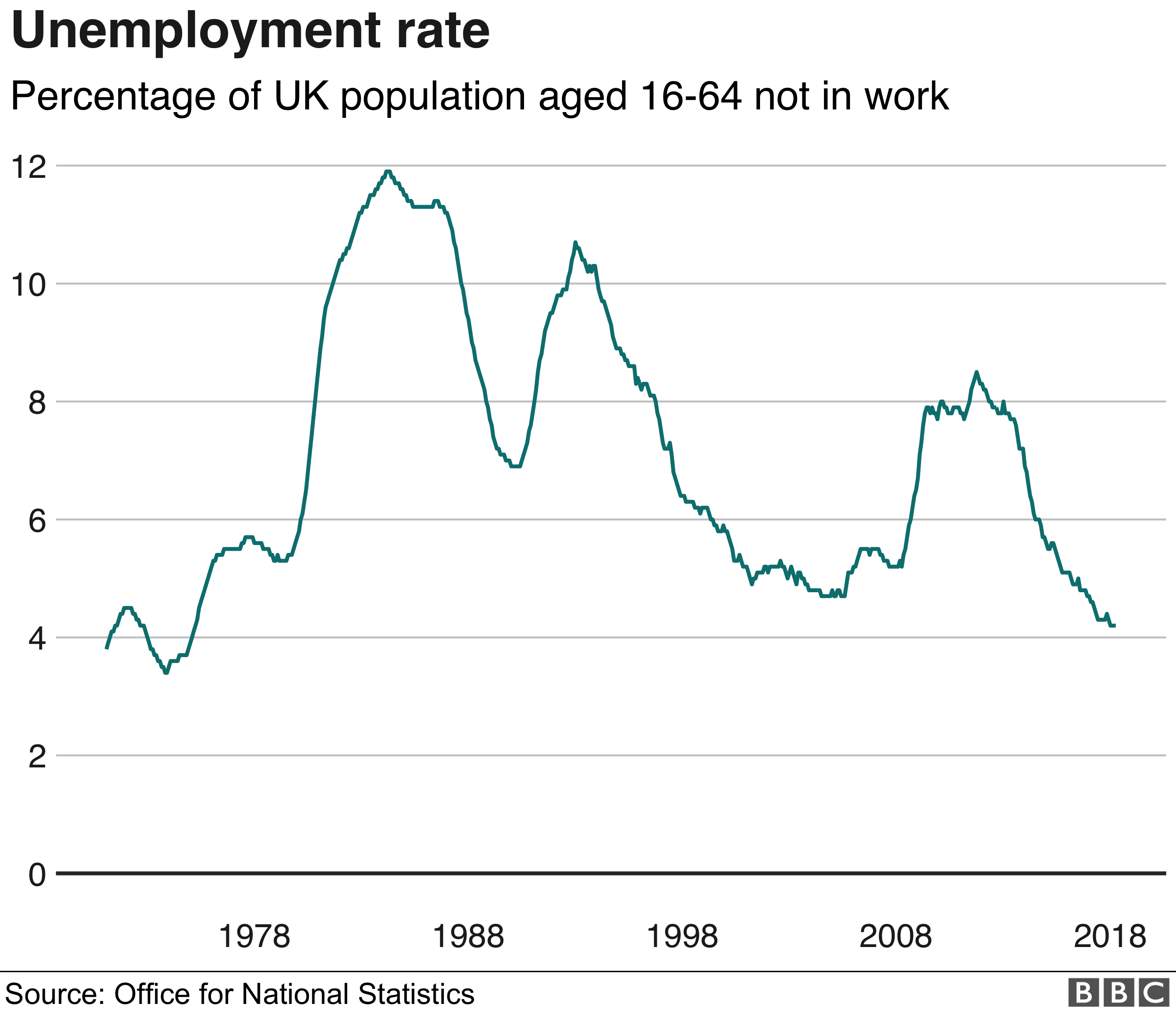

Salary enlargement slipped to 2.7% from 2.8% within the 3 months to Would Possibly, at the same time as unemployment fell by way of 12,000 to 1.41 million, the Place Of Job for Nationwide Data (ONS) stated.

The unemployment rate remained at its joint lowest seeing that 1975 at 4.2%.

Some analysts said the slowdown in wage growth may dampen expectancies of an rate of interest rise subsequent month.

Salary enlargement is one in every of the important thing figures that the Financial Institution of england displays to evaluate the health of the uk economy.

the share of people in work rose to a report high of 75.7%.

“We Have had yet one more document employment fee, whilst the selection of task vacancies could also be a brand new file,” mentioned ONS statistician Matt Hughes.

“From this, it is clear that the labour marketplace continues to be rising strongly.”

What may an rate of interest rise imply for you? Productiveness puzzle weighs on UK expansion

The Financial Institution of england’s Financial Policy Committee meets on 2 August to come to a decision whether or not to lift rates of interest from their current stage of HALF%.

At their last assembly in June, the nine-member MPC used to be split 6-THREE, with dissenters calling for a quarter-element rise to 0.75%.

‘Anaemic enlargement’

Ben Brettell, senior economist at Hargreaves Lansdown, known as the most recent figures on wages and jobs “mildly disappointing”.

“All in all, these numbers don’t regulate the economic image of anaemic enlargement, a relatively tight labour market and below-regulate inflation,” he stated.

“Markets are still anticipating the Bank of britain to boost interest rates in August. However given the more and more uncertain climate, i feel there is a real probability policymakers will sit on their fingers and wait for firmer signs the financial system is on the right observe before risking raising borrowing costs.”

However, Andrew Wishart, UK economist at Capital Economics, said he didn’t think the most recent information would deter the Bank from elevating charges.

“the recent easing in wage enlargement appears not going to be sustained,” he mentioned.

“Best signs of pay recommend that it is on target to a minimum of meet the Bank of britain’s forecast for underlying wage enlargement of 2.75% y/y in THIS FALL. As such, we proceed to be expecting the MPC to vote to raise rates of interest subsequent month.”

Suren Thiru, head of economics on the British Chambers of Trade (BCC), said the latest slowdown in pay enlargement was once “disappointing”.

“This Implies that earnings enlargement in actual phrases remains in sure territory by way of just a small margin and so is unlikely to supply a lot of a boost to shopper spending energy,” he mentioned.

“Even As we expect that interest rates will rise sooner in preference to later, with profits enlargement underwhelming, there is still enough scope for the MPC to maintain a charges hike on dangle for longer, in particular given the present financial and political uncertainty.”

Tej Parikh, senior economist on the Institute of Directors, stated: “Clamour for an August rate of interest upward thrust has been building, but the sluggish pay growth should supply pause for thought.

The Bank will have to pay heed to the array of stumbling blocks standing within the manner of companies, from the load of industrial rates to Brexit uncertainty, while it comes to making its choice.”