Symbol copyright Getty Photographs Image caption The Chinese automobile trade has been affected by closing week’s US tariffs

Symbol copyright Getty Photographs Image caption The Chinese automobile trade has been affected by closing week’s US tariffs

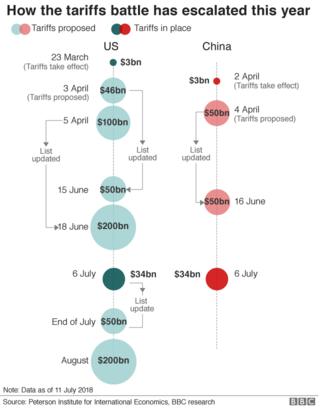

After US tariffs on $34bn (£25.7bn) of Chinese items came into impact closing week, China is very much in President Trump’s firing line.

More is coming: details of every other $16bn value are already within the pipeline and President Trump has ordered the management to organize to gather price lists on £200bn of Chinese Language business on best of that.

China’s industry coverage is bigoted, he argues, and it steals the generation of yankee companies.

Trump’s place is shared by means of his trade adviser Peter Navarro, who co-wrote a e-book, Loss Of Life through China, which was additionally made right into a documentary movie. Mr Navarro warns of the threat he thinks that China poses to US interests.

The bare figures of China’s rise as a industry power are indisputably striking.

Symbol copyright Getty Pictures Symbol caption Trump accuses China of behaving unfairly while it comes to international industry

Symbol copyright Getty Pictures Symbol caption Trump accuses China of behaving unfairly while it comes to international industry

nevertheless it could also be a number one marketplace for other countries. China ranks 2nd as an importer of each items and services.

China does on the other hand do extra of the former – exporting – than importing. there may be a considerable imbalance in its trade with the rest of the world.

The Usage Of a fairly wider measure, called the present account of the steadiness of payments, which includes business, China had a surplus ultimate yr of $165bn.

that may be huge, but it’s not the largest. Germany and Japan have bigger surpluses, and President Trump has taken factor with them to boot.

Image copyright Getty Pictures Image caption China has already retaliated with tariffs on US exports, together with lobsters

Image copyright Getty Pictures Image caption China has already retaliated with tariffs on US exports, together with lobsters

it’s a matter of discussion how so much those imbalances matter, and whether or not they are the end result of countries’ trade insurance policies.

Most economists would let you know that a united states’s overall business steadiness is the outcome of savings and funding by way of industry and families, and executive tax and spending insurance policies; that it is no longer determined via trade insurance policies.

A country that spends greater than it produces will have a business deficit, akin to the u.s..

one that earns more than it spends may have a surplus. China, with very prime ranges of household financial savings, is one example.

That does not imply that executive policies are not an element. Tax and spending policies, rates of interest, trade fee insurance policies, and labour market policies can all have an effect on financial savings and funding and the trade balance.

Symbol copyright Getty Pictures Image caption Chinese tractors have additionally been hit through US tariffs

Symbol copyright Getty Pictures Image caption Chinese tractors have additionally been hit through US tariffs

but it surely isn’t, so much economists would say, pushed essentially through trade insurance policies.

It have to be mentioned that this is counterintuitive, and it is no longer a view shared via President Trump. He tends to look the imbalance as the outcome of China’s trade and different policies together with subsidies, foreign money manipulation and the acquisition of others countries’ technology.

His management used to be specifically critical of the “Made in China 2025” initiative, under which Beijing wants to support the country’s position in a bunch of key advanced sectors of business, together with pharmaceutical products, plane and robotics.

The Place Of Job of the u.s. Trade Representative has defined it as a part of a plan of “seizing financial dominance of certain complicated technology sectors”.

What is beyond dispute is China’s massive economic presence.

there was a key moment in China’s upward push early in the provide century, while it joined the arena Industry Organization.

That imply that China’s get admission to to overseas markets – equivalent to the levels of price lists it faced – was protected via the WTO’s rule e-book.

President Trump believes that was once a mistake, that there has been a missed chance to power China to open its personal markets.

A 2017 report to Congress from the us Industry Consultant wrote: “it sort of feels clear that the United States Of America erred in aiding China’s access into the WTO on phrases that have proven to be ineffective in securing China’s embrace of an open, market-oriented trade regime”.

International Business

More from the BBC’s collection taking a global point of view on business:

Charting the u.s.-China business fight How a US-China business war may just hurt us all Is the eu Union a ‘protectionist racket’? New Zealand satisfied to omit the UK’s ‘betrayal’ Where does Trump’s ‘America First’ leave Canada? Trump’s double danger to world free business

the united states is now proceeding to hit back, with remaining week’s extensive-ranging price lists, and this week’s announcements, coming after existing levies on imports of Chinese Language steel and aluminium.

Regarding these two metals there’s excess world capability, which displays, no less than in part, the investment China has made.

Since the flip of the century China’s steel production has higher six-fold, even though it did decline relatively within the prior few years. China’s aluminium manufacturing has increased much more rapidly.

US issues about China’s metals production, and Beijing’s technique to obtaining overseas era, are shared by way of a bunch of other prime trade powers, together with the eu Union. and also via earlier US administrations.

the eu has continuously pressed China to tackle what it considers its excess steel and aluminium capability, and complained to the WTO approximately a lot the same highbrow belongings and technology issues.

Image copyright Getty Photographs Symbol caption the united states has long accused China of maintaining the yuan artificially undervalued

Image copyright Getty Photographs Symbol caption the united states has long accused China of maintaining the yuan artificially undervalued

George Magnus, of the China Centre at Oxford University, says that President Trump has some degree in relation to China’s industrial and industrial insurance policies.

Foreign firms desirous to operate in China have to work with a Chinese Language spouse in some way that implies they can easily lose regulate in their era.

He highlights China’s advances in prime-speed rail and electrical cars.

The Place the european and others section company with President Trump is in his enthusiasm for unilaterally enforcing additional trade boundaries on China. Needless to mention, they’re even less enthusiastic about the metal and aluminium tariffs, which are also hitting US allies.

Every Other allegation steadily levelled at China is that of manipulating its trade price to achieve a aggressive merit. a cheaper foreign money makes it more uncomplicated for a country to promote its goods abroad.

It was a more broadly held concern in the closing decade, however the Chinese Language foreign money has risen due to the fact that then, casting off some of that aggressive benefit.

That said, it is a weapon that China may be able to use because it continues to respond to the us price lists on its items.