Image copyright AFP Image caption Argentines are indignant that the government became to the IMF (FMI in Spanish)

Image copyright AFP Image caption Argentines are indignant that the government became to the IMF (FMI in Spanish)

Argentina has been known as the comeback child of the global economy. Over the past years its industry-friendly President, Mauricio Macri, has been praised because the guy to put the country on the right monitor to a brighter monetary future. But closing week, its currency was at an all-time low and its treasury minister travelled to Washington to strike a care for the World Monetary Fund. Where did it all go wrong?

How did the drawback get started?

Argentina has been affected by financial problems for years however the commodities boom of the earlier decades helped the rustic pay off the money it owed to the World Financial Fund (IMF). It cleared its entire debt to the multilateral employer in 2007.

Image copyright Reuters Symbol caption Many in Argentina blame the IMF for the 2001 economic obstacle

Image copyright Reuters Symbol caption Many in Argentina blame the IMF for the 2001 economic obstacle

Argentina’s economy began to stabilise underneath President Néstor Kirchner, who ruled from 2003 to 2007, but turned into extra shaky again underneath his spouse and successor in workplace, Cristina Fernández de Kirchner.

Her govt, which was in power from 2007 until 2015, raised public spending, nationalised corporations and closely subsidised many pieces of way of life starting from utilities to soccer transmissions on television.

Most importantly it managed the trade rate, which created all types of sensible issues comparable to giving upward thrust to a black market for bucks and closely distorting costs.

Symbol copyright EPA Image caption The Argentine Important Bank has issued many extra quick-term bonds

Symbol copyright EPA Image caption The Argentine Important Bank has issued many extra quick-term bonds

Considering The Fact That President Macri took administrative center, the Argentine Significant Financial Institution very much expanded its issuance of Lebac (brief for Letras del Banco Imperative, or Vital Bank Notes), short-term Argentine bonds with beautifully top rates of interest.

Investors could change their greenbacks for pesos, put money into Lebac bonds – which mature in as little as 35 days and provide a annually rate of interest of 29% – after which promote their pesos for bucks again. this practice is called lift trade and it used to be performed by means of every kind of traders, from massive banks to small savers.

For a while, buyers simply rolled debt on from one bond to another. However in April, many started to leave Argentina, fearing President Macri would not have the opportunity to deliver on his promise to convey down inflation.

Additionally, with the possibility of the us elevating its personal interest rates, many regarded as they had made enough money in Argentina and it was time to recalibrate risks. Like a poker participant on a winning streak, traders felt the percentages of the next guess being a losing one were expanding with time.

The mass exit made the peso lose almost 1 / 4 of its worth.

Can the IMF help?

Argentina’s govt insists its drawback lies with liquidity (a lack of money) and not with solvency (its ability to fulfill its financial responsibilities).

IMF problems caution on global debt

It argues that subsequently the IMF is the most cost effective source of financing available. With money from the IMF, Argentina may have the option to interfere in currency markets for longer and also repay bonds coming up for payment.

President Macri says the cash will help him perform his financial policy of “gradualism”, which goals to tackle inflation with established reforms as opposed to with surprise measures.

What do Argentines recall to mind all this?

Image copyright AFP Symbol caption Argentines have seen the price in their currency plummet prior to

Image copyright AFP Symbol caption Argentines have seen the price in their currency plummet prior to

Argentines have been through so much economic turmoil, they are now not fast to panic. lots of the people I spoke to in Buenos Aires final week shrugged off the concern and stoically answered: “We’re from Argentina. we’re used to this”.

But there are other people expressing severe concern, particularly the ones from the older technology which lived via Argentina’s 2001 financial predicament when the federal government defaulted on its debt and the banking system was largely paralysed.

The impact on Argentines had been devastating with many seeing their laborious-received prosperity temporarily disappearing.

Those who skilled it concern a return of the corralito (ring fence), the Spanish title given to executive restrictions imposed in 2001 to prevent a bank run.

Below the corralito’s constraints, which lasted for a year, other people couldn’t freely withdraw money from their debts, making existence very tough for unusual Argentines.

What happens subsequent?

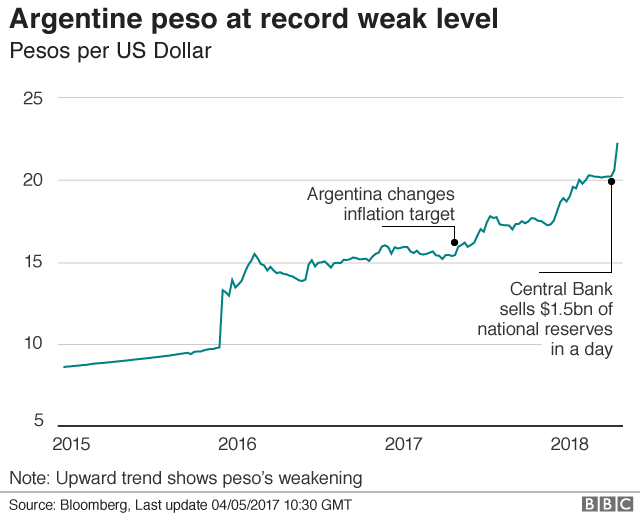

All eyes are on Argentina’s alternate price, which at the moment is soaring at round 23 pesos to the greenback. that is an all-time low for the peso and a worrying signal of its devaluation.

If the speed were to dip under 20 pesos and keep there, it might be a sign of the problem having been contained.

There are a number of rigidity assessments arising which might also give an inkling of items to come.

On Tuesday, $30bn (£22bn) in Argentine bonds arise for payment. the federal government has to search out a way to persuade traders to roll on this debt, in a different way the run on the peso gets so much messier.

Another check will likely be the IMF’s answer to Argentina’s request for billions of greenbacks in loans. In 2001, the IMF pulled the plug on Argentina and denied it financial reinforce. what is going to it do that time?

is that this the top of Macri’s government?

Image copyright AFP Image caption Mauricio Macri’s transfer to invite the IMF for a deal is a dangerous strategy

Image copyright AFP Image caption Mauricio Macri’s transfer to invite the IMF for a deal is a dangerous strategy

Beneath President Macri, Argentina went from being an economy that trusted executive overspending to 1 that depended on debt issued to unstable overseas investors.

Many imagine Mr Macri is doomed, particularly as going to the IMF is probably the most unpopular transfer a president can make in Argentina, the place the agency is broadly loathed and blamed for the 2001 financial cave in.

Mr Macri additionally has different issues such as not having been capable of ship on his promise to convey down inflation.

Congress has also just licensed a bill that impedes the president from scrapping a few subsidies. If he vetoes the invoice that could positioned him at loggerheads with lawmakers.

The president is making an attempt to venture trust. He still has hopes of being re-elected subsequent year however for that to happen he will wish to include this trouble quickly.