Symbol copyright Aston Martin Image caption The Aston Martin DB11 used to be introduced in 2016

Symbol copyright Aston Martin Image caption The Aston Martin DB11 used to be introduced in 2016

Luxury carmaker Aston Martin says it should go with the flow at the London inventory marketplace, completing a turnaround that has noticed the company spice up gross sales and income.

The checklist could be the primary by way of a UNITED KINGDOM carmaker for years, following the sale of brands reminiscent of Jaguar, Bentley and Rolls-Royce to foreign homeowners.

Analysts say the company, which also on Wednesday posted part-yr income of £42m, would be price as much as £5bn.

Its primary shareholders are an Italian funding fund and Kuwaiti investors.

The ONE ZERO FIVE-12 months-old carmaker mentioned in its announcement that it might to start with float a minimal of 25% of the corporate.

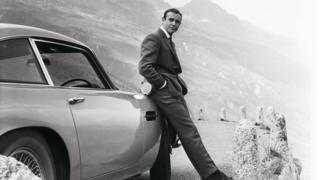

Symbol copyright Aston Martin Symbol caption Sean Connery – together with his Aston Martin – as James Bond in ‘Goldfinger’

Symbol copyright Aston Martin Symbol caption Sean Connery – together with his Aston Martin – as James Bond in ‘Goldfinger’

Regardless Of an illustrious history and a logo title synonymous with 007 motion pictures, Aston Martin has struggled for decades to make a benefit. But below Mr Palmer, a former Nissan govt, the corporate has been broadening its product range and has moved into new areas.

the corporate is keen on tasks to build an electric flying car, luxurious properties in the US, and even a private submarine. “we are a luxury corporate and not just a automobile corporate,” Mr Palmer informed Radio FOUR’s Nowadays programme.

It expects complete-yr gross sales for 2018 to upward push to among 6,TWO HUNDRED and six,400 devices, and within the medium-time period it aims to construct just about 10,000 within the 2020 calendar year.

Aston Martin’s ‘sports automobile for the skies’ Aston Martin roars again into the black Rolls-Royce takes high street with new SUV

part of the turnaround technique technique involved targeting female buyers – no simple job given the company has bought fewer than FOUR,000 automobiles to women in its ONE HUNDRED AND FIVE-yr historical past.

Aston Martin should be less dependent on a slim portfolio and one form of purchaser, Mr Palmer says.

He said he was unconcerned that the inventory market list could come prior to Brexit and possible trading uncertainties. “the ease of being a luxurious company is we are reasonably impervious to these roughly changes,” he instructed the BBC.

Aston Martin exports 25% of its car to the european Union. “We Would most probably take pleasure in a weaker pound,” he mentioned. Then Again, he said the carmaker used to be increasing its stockpile of engines, made in Germany, from three to five days “just to are living a little bit bit of insulation” in opposition to Brexit disruption.

Symbol copyright Aston Martin Image caption Aston Martin has joined a consortium that incorporates jet engine maker Rolls-Royce on a “flying car” mission

Symbol copyright Aston Martin Image caption Aston Martin has joined a consortium that incorporates jet engine maker Rolls-Royce on a “flying car” mission

Alongside the flotation statement, Aston Martin additionally disclosed its first-half results, reporting an 8% 12 months-on-12 months sales build up to £445m for the six months ended 30 June.

It said the efficiency used to be driven via its consulting trade besides as higher earnings from gross sales of its unique version automobiles, together with the Vanquish Zagato circle of relatives and DB4 GT Continuation models.

Mr Palmer mentioned: “As Of Late’s effects display that we have persevered to ship sustainable expansion, margins and value for our shareholders even as launching three new fashions and variants in the primary 1/2 the yr.”

As part of the restructuring, Aston Martin it to open a brand new factory at St Athan, in Wales, in 2019.

Hargreaves Lansdown analyst Laith Khalaf said Aston Martin’s stock marketplace value could put it close to the top of the FTSE 250 proportion index.

He said the luck of Ferrari’s floatation in Ny in 2015 boded well for the uk company’s plans and underlined investors’ urge for food for such luxurious manufacturers.

But Mr Khalaf brought: “It Is Necessary for possible traders to pay attention at the corporate’s monetary prospects and never to get over excited by means of the logo.”