Symbol copyright Getty Photographs

Symbol copyright Getty Photographs

Up To 8.3 million folks within the UNITED KINGDOM are not able to repay money owed or household bills, in line with a file from the Nationwide Audit Place Of Work (NAO).

It says that HM Treasury needs to do extra to understand the scale of downside debt, and how it affects other people’s lives.

So what are shoppers’ choices while it comes to borrowing, and how much is the common household debt?

How does debt paintings?

There are best types of debt whilst it involves borrowing cash: secured and unsecured.

Secured debts are typically tied to an asset. A mortgage is an instance of a secured debt – the mortgage loan is secured by means of the valuables, and the lender can repossess it if the borrower falls in the back of on their payments.

Image copyright BBC News

Image copyright BBC News

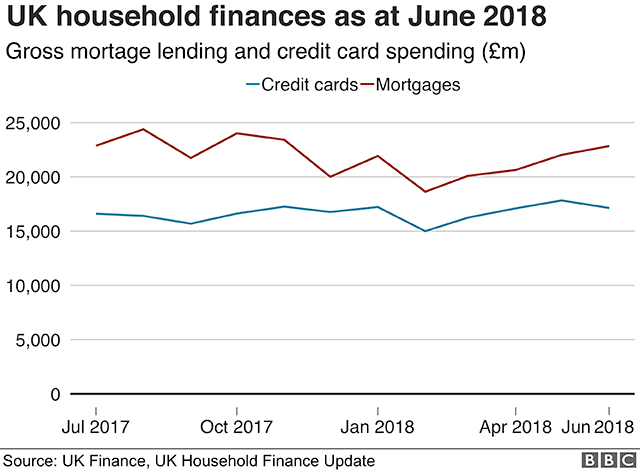

UNITED KINGDOM cardholders with cards issued through banks, development societies or non-bank credit providers spent £17.1bn in June 2018. The Price of spending on playing cards issued by way of UNITED KINGDOM top street banks was £11.1bn in July – up 8.1% on the previous yr.

UK Finance said the increase in spending was all the way down to higher retail sales on account of the world Cup and the warm weather.

Other sorts of borrowing include:

Agreeing an overdraft should you have a bank account eliminating a mortgage from a credit score union (not-for-profit co-operatives run by individuals who pool their savings to lend to every different)

New figures from the Bank of england show that credit score unions are at the upward thrust. The UNITED KINGDOM’s credit union club handed million for the primary time, within the first 3 months of 2018.

What’s the average debt?

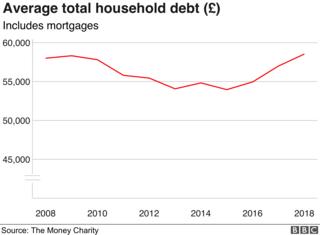

the typical UNITED KINGDOM family debt (together with mortgages) was once £58,540 in June, in step with monetary charity The Money Charity.

Overall in the UK, other folks owed nearly £1.6 trillion at the finish of June 2018, up from £1.55tn a 12 months in the past.

Image copyright BBC News

Image copyright BBC News

UK households saw their annual outgoings surpass their source of revenue for the first time in nearly 30 years in 2017, in step with the Office for Nationwide Information (ONS).

The ONS says that customers are borrowing more and saving less because the financial institution price – which dictates returns on financial savings and the scale of loan payments – has been near a file low for the earlier decade.

Symbol copyright BBC News

Symbol copyright BBC News

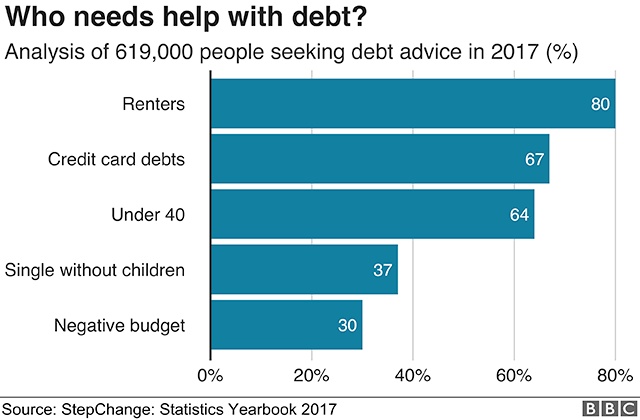

According To debt charity StepChange, the collection of younger other folks in search of debt recommendation has been expanding in recent years.

more than 619,000 folks contacted the charity for recommendation in 2017 and so much of them were below the age of 40. StepChange shoppers could fall into one or extra of the above classes.

Why are payday loans debatable?

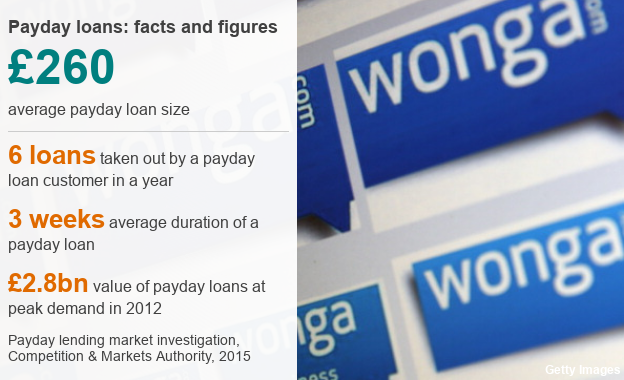

A payday lender usually provides loans for fewer than 30 days, with no lengthy utility process.

Payday loans are brief-term loans for small sums, designed to tide other folks over until they subsequent get paid.

Payday loan companies were criticised by debt charities for charging high interest rates and one-off charges to inclined consumers if they fail to pay off their loans on time.

Symbol copyright BBC Information

Symbol copyright BBC Information

The Monetary Behavior Authority (FCA) made up our minds to cap the cost of payday loans at 0.8% of the volume borrowed consistent with day and impose a £15 limit on default charges from January 2015. It stated that nobody should have to repay more than double the unique amount borrowed.

It also stressed that loans will have to best be made to people who were in a position to repaying the cash.

What does the hot building up in interest rates imply for debtors?

The Bank of britain raised rates of interest from 1/2% to 0.75% in August, making financial stipulations higher for savers rather than debtors.

Those most influenced would come with other people on a regular variable fee mortgage, whose per month payment charges don’t seem to be mounted.

the increase result in a rise on rates for other forms of borrowing like personal loans and credit cards.

For additional information and strengthen on debt, seek advice from BBC Motion Line.