Image copyright Reuters

Image copyright Reuters

The Bank Of Britain has raised the rate of interest for less than the second one time in a decade.

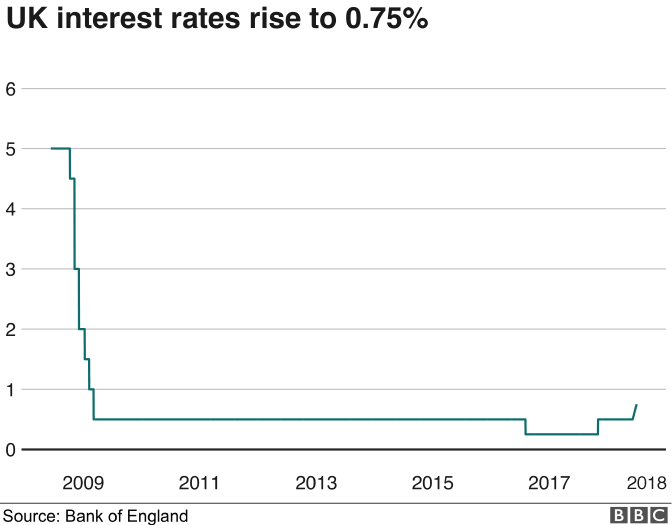

The fee has risen by way of a quarter of a proportion aspect, from 0.5% to 0.75% – the highest level considering the fact that March 2009.

While the decision signifies that the THREE.5 million people with variable or tracker mortgages can pay more, the rise can be welcomed via savers.

Mark Carney, the Financial Institution’s governor, stated there would be additional “sluggish” and “limited” rate rises to come back.

interest rates: Your questions replied What an interest rate upward thrust manner for you The interest rate upward push is all approximately your wages Savers is not going to expect too much from a rate upward push Five things we realized from the Financial Institution Of Britain Email haveyoursay@bbc.co.uk with your stories

Some industry teams questioned the verdict to raise the rate now sooner than the uk agreeing a Brexit take care of the european Union.

Symbol copyright Getty Pictures Symbol caption Householders with a variable price or tracker mortgage will face an increase in payments

Symbol copyright Getty Pictures Symbol caption Householders with a variable price or tracker mortgage will face an increase in payments

The Financial Institution is sticking to earlier guidance that there can be further rate of interest rises, however Mr Carney mentioned those can be “limited and slow”.

“Rates can be anticipated to upward thrust gradually. Coverage needs to walk, not run, to stand still,” he mentioned.

However, the Institute of Administrators said the Financial Institution had “jumped the gun” through raising the speed now.

It stated: “the rise threatens to dampen shopper and industry trust at an already fragile time.

“Expansion has remained subdued, and the recent partial rebound is the least that could be anticipated after the shortage of growth in the year’s first quarter.”

Five interest rate facts

More than THREE.5 million residential mortgages are on a variable or tracker rateThe reasonable standard variable price mortgage is 4.72% On a £ONE HUNDRED FIFTY,000 variable mortgage, an increase to 0.75% is likely to increase the yearly price through £224 A Financial Institution rate upward thrust does not ensure the equivalent increase in pastime paid to savers. Half did not transfer after the remaining fee riseNo easy accessibility financial savings account at an incredible Prime Street financial institution will pay interest of greater than 1/2%

The Bank mentioned a select-up within the economic system is being supported by means of household spending, which the Bank said had been “erratic” in advance in the year.

It may be believes the recent series of store closures on the Top Street does not mirror a loss of urge for food for shopping.

In its Quarterly Inflation Report, the Bank stated: “Despite The Fact That within the past 12 months the choice of retail closures have greater and retail footfall has fallen, contacts of the Bank’s dealers counsel that mainly displays shifts in consumer demand to on-line stores and from goods to products and services.”

Image copyright Getty Photographs Symbol caption The Bank Of Britain mentioned a industry row between the u.s. and China used to be weighing at the global financial outlook

Image copyright Getty Photographs Symbol caption The Bank Of Britain mentioned a industry row between the u.s. and China used to be weighing at the global financial outlook

It said the outlook for the global economy was slightly gloomier, partially due to the business war between the u.s. and China which has noticed price lists imposed on a variety of items.

It also highlighted a slowdown in the uk housing marketplace this 12 months, which has been “concentrated in London”, the place mortgage completions are down 12% on 2016.

But the Bank thinks that weak spot would possibly just be particular to the capital and may now not say much about the possibilities for the united kingdom housing market as a whole.

What happens subsequent?

The Financial Institution is sticking to its steering that rates of interest will proceed to go upper, but handiest at sluggish pace and to a limited extent.

The financial markets have taken this on board and are forecasting one, and perhaps , rises of 0.25% prior to 2020.

It also seems not going the united kingdom will go back to rates of interest of 5% and above. In its inflation report ,the Bank revealed what it thinks is the natural rate of interest for the uk economy.

It puts that at between 2% and 3%.

That relatively low rate is partly due to an ageing population.

Older other folks are likely to store extra and within the long term, so we can provide a better pool of savings for lending to households and trade and assist prevent the financial system from overheating.