Symbol copyright Getty Pictures

Symbol copyright Getty Pictures

Client teams have highlighted their worry over the “important minority” of scholars facing overdraft debts on a normal basis.

Two separate studies are alerting undergraduates to the risks of a debt spiral, although they also be aware many are assured managing their cash.

After A-level and vocational ends up in contemporary days, many teenagers will now be taking into account further training investment.

That way choosing from an array of student financial institution accounts.

Shopper team Which? mentioned that providers have been tempting new students with perks ranging from railcards and Amazon vouchers to more traditional festival among rates of interest.

Where to head for assist

Student finance: What you want to grasp, from the independent Cash Advice Carrier Store The Scholar site Repairs loans and gives you information in England, Wales, Scotland, And Northern Ireland Cash and investment, from the Nationwide Union Of Scholars

The survey of five,000 students, carried out with the Nationwide Affiliation of Scholar Cash Advisers, found that 38% of existing students had some type of exceptional non-scholar loan debt.

Some 18% of those asked had debts of one,000 or more, with some turning to payday loans to hide living costs.

While some faced financial difficulties, there was some optimism in the document over how well many students care for their budget.

Eight in 10 stated that they stored track in their personal expenditure, with three in five atmosphere a budget.

Symbol copyright Getty Photographs

Symbol copyright Getty Photographs

Joe Surtees, from The Cash Recommendation Carrier, stated: “Our analysis demanding situations the speculation that scholars are financially irresponsible. So Much seem to display signs of being financially capable, holding an in depth observe of their money and typically hanging savings aside for a wet day.

“Then Again, an important minority are still being affected by their price range, which can building up the chances of falling right into a spiral of debt in the long term. most importantly if you are struggling, don’t be afraid to hunt assist.”

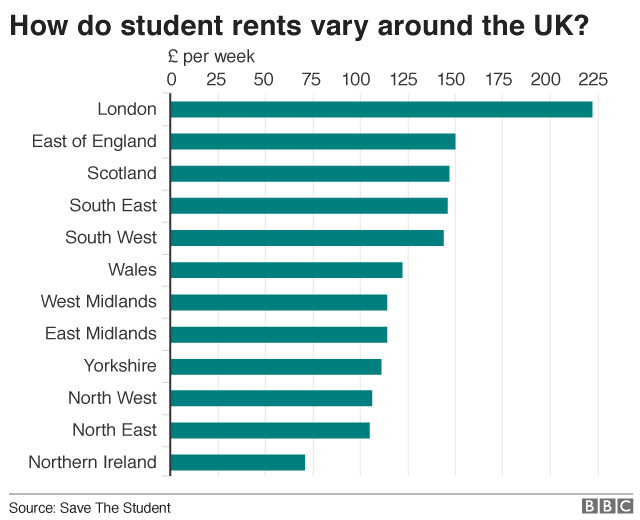

The experiences come after previous analysis discovered the level to which rent is responsible for draining student price range.

A survey earlier this yr, by way of student finance site Retailer The Coed, claimed that moderate rent for pupil accommodation totalled £131 per week, consuming up nearly all of a regular repairs mortgage or supply, even sooner than a standard £509 in prematurely letting charges and deposit had been taken into account.

The average award left a standard UK student with simplest £EIGHT per week for all other dwelling prices corresponding to meals, commute and toiletries, after the hire has been paid.

The repairs loan is designed to hide dwelling costs, is cut loose the scholar loan to pay for tuition charges, and relies on family family income.