Image copyright Getty Photographs Image caption The U.s. and China: poles apart?

Image copyright Getty Photographs Image caption The U.s. and China: poles apart?

As a US-led trade struggle rages on, a few companies are starting to really feel the pain.

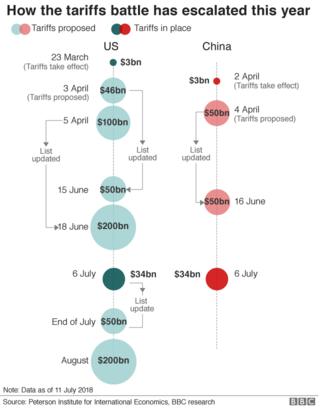

The Us has been embroiled in a tit-for-tat trade fight on several fronts over the prior few months.

The one that is growing the most interest is the one with China, as the world’s greatest economies wrangle for world influence.

Some say President Trump is trying to boost power on China prior to key mid-time period elections at home in November.

within the up to date transfer, China said on Friday that it might levy new tariffs on greater than 5,2 HUNDRED US products if the us is going in advance with its latest danger to impose 25% price lists on $200bn (£152bn) of Chinese Language items.

Six ways China may just retaliate in a industry struggle How a US-China industry battle could hurt us all US-China trade row: What has happened to this point?

Six ways China may just retaliate in a industry struggle How a US-China industry battle could hurt us all US-China trade row: What has happened to this point?

Earlier this year, the united states also began charging levies on the imports of steel and aluminium, together with from the european Union, Mexico, and Canada. These international locations have retaliated.

Here are some of the principle sectors finding themselves sufferers of the trade struggle so far.

Cars and motorbikes

The automotive business turns out to were essentially the most affected up to now, with 3 top automakers not too long ago caution that changes to trade policies are hurting performance.

Ford and Basic Vehicles decreased profit forecasts for 2018, bringing up higher metal and aluminium costs due to new US price lists.

Fiat Chrysler additionally reduce its 2018 revenue outlook after gross sales in China slumped, as consumers postponed purchases in anticipation of lower automobile tariffs.

In Might, China introduced that it could lower tariffs on imported vehicles from 25% to fifteen% on 1 July in a move seen as an attempt to cut back business tensions with the u.s.. However shortly after, on 6 July, it increased price lists on US-made cars to FORTY% in retaliation to the u.s.’s transfer to tax $34bn of Chinese Language merchandise.

Jaguar Land Rover, the UK’s biggest car company, additionally not too long ago mentioned a loss for the first time in three years after sales slowed down in China. some of the purposes, it mentioned many patrons had behind schedule purchases due to a metamorphosis in Chinese Language import duties.

Image copyright Getty Images Symbol caption JLR has seen gross sales slow in China

Image copyright Getty Images Symbol caption JLR has seen gross sales slow in China

Ecu and US car firms are also responding via expanding prices in China.

BMW recently stated it will carry prices on two of its fashions from 30 July due to the larger import responsibility on US-made cars in China. Tesla has also reportedly larger prices on two of its fashions.

However, there has also been a favorable impact for China, as Anna-Marie Baisden, head of vehicles research at Fitch Solutions, points out.

“we’ve noticed a number of carmakers, together with Tesla, accelerating plans to take a position in native production facilities to bypass import tariffs,” she says.

Different firms within the broader industry also are taking into consideration their options.

“Sarcastically a few of the hardest-hit companies are American or producing in the u.s., even though the tariffs imposed through the us are supposed to assist household corporations,” says Ms Baisden.

US motorcyle maker Harley-Davidson plans to shift some manufacturing away from the united states to circumvent the “substantial” burden of European Union tariffs, imposed in retaliation to US duties on metal and aluminium.

Food and drink

Some firms within the food and beverages industry also are reducing their outlooks and putting up their costs to cope with the new status quo.

Tyson Foods just lately minimize its benefit forecast, announcing retaliatory tasks on US beef and beef exports had reduced US meat costs.

US spirits and wine massive Brown-Forman has mentioned it’ll build up the fee of Jack Daniel’s and different whiskeys in a few Eu international locations, in line with media reports.

Coca-Cola has also said it will building up prices in North The Us this yr to catch up on higher freight charges and steel costs, consistent with the Wall Side Road Journal.

Symbol copyright Getty Pictures Image caption Coca-Cola is raising its prices in the united states in reaction to better costs

Symbol copyright Getty Pictures Image caption Coca-Cola is raising its prices in the united states in reaction to better costs

Different victims

Other corporations are looking for to do much less industry with China as some way of avoiding the tariffs.

Toymaker Hasbro is shifting extra manufacturing out of China, US conglomerate Honeywell wants to use more supply chain assets from international locations outside China and residential furnishing corporate RH expects to cut the volume of goods sourced from China, according to Reuters.

Meanwhile, US apparatus maker Caterpillar just lately said sturdy call for had allowed it to hike costs to offset $100m-$200m in higher steel and aluminium prices.

World economy

The Global Financial Fund says an escalation of the tit-for-tat tariffs may just shave 0.FIVE% off world growth by way of 2020.

Separate releases lately confirmed expansion in China’s production sector slowing in July and one measure of us shopper sentiment falling because of tariff concerns, in line with media reports.

Morgan Stanley estimates that a full-blown escalation of the industry dispute may just knock 0.81 share issues off world gross domestic product. This scenario could involve the u.s. slapping 25% price lists on all goods from both China and the eu, and them responding with identical measures.

The financial institution said such a lot of the effect from tariff hikes on expansion may probably be noticed best in 2019.

Most of the impact – or virtually EIGHTY% – might come thru a disruption of domestic and world provide chains, the bank brought.