Image copyright Getty Photographs Symbol caption Higher transport prices contributed to the rise in inflation remaining month

Image copyright Getty Photographs Symbol caption Higher transport prices contributed to the rise in inflation remaining month

UNITED KINGDOM inflation rose to 2.5% in July, after holding stable at 2.4% within the previous three months, as the value of delivery and computer video games increased.

It was once the first leap within the Client Prices Index (CPI) measure on account that November and was once in line with forecasts.

Meanwhile the Retail Prices Index (RPI) measure of inflation fell to 3.2%.

The Department for Shipping uses the RPI figure to set the maximum annual increase for regulated rail fares.

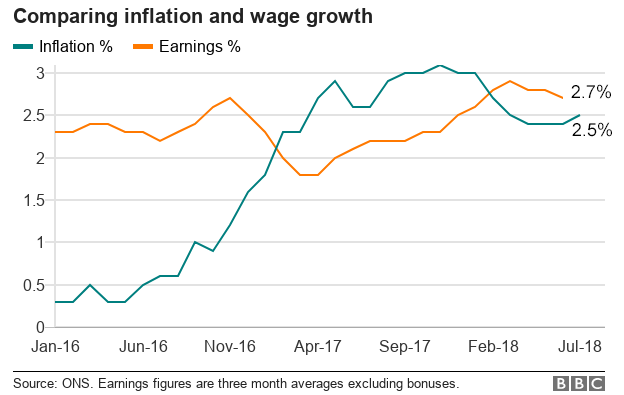

Despite the upward thrust for CPI, wage growth continues to be outstripping inflation. On Tuesday, the Place Of Business for National Information stated that average profits, except bonuses, rose by means of 2.7% for the three months to June.

Wednesday’s inflation figures show that increases in computer games and transport – up 5.6% within the 12 months ending July 2018 – had been partly offset by means of falls in the value of clothing.

For producers, the fee of uncooked materials used to be 10.9% upper than in July 2017, the largest rise in more than a 12 months.

Much of that value drive has been due to oil value will increase of more than 50% over the duration.

Regulated rail fares to upward thrust 3.2% Unemployment at lowest considering that 1975 UNITED KINGDOM growth boosted through warmer weather

The CPI figure had hit a five-year top of 3.1% in November, while the inflationary impact of the pound’s fall following the June 2016 Brexit vote reached its peak.

Earlier this month the Bank of britain forecast inflation would rise to 2.6% in July before falling again.

The Financial Institution expects inflation will calm down to only above its 2% target in years’ time as it steadily increases interest rates.

‘Little respite’

Tej Parikh, senior economist at the Institute of Administrators, stated the rise in inflation confirmed the cost of residing squeeze was not yet something of the earlier.

“For families this isn’t good news, because the already susceptible expansion in their pay packets is being further eroded by top costs. this is more likely to crush consumer spending, posing recent issues for embattled top boulevard companies,” he said.

“because the brief factors pushing costs up fade away, inflation is anticipated to slowly fall again with regards to the target price, but if you want to be offering little respite for staff without a significant pickup to their salaries in tandem.”

Samuel Tombs at Pantheon Macroeconomics brought: “Except inflation in the services sector strengthens dramatically, CPI inflation will fall under the two% objective in the first 1/2 subsequent yr.”