Image copyright Getty Images

The downfall of Carlos Ghosn has despatched shockwaves throughout the world car business.

Remaining week he used to be arrested on suspicion of monetary misconduct and pushed aside from his submit as chairman of the japanese automotive massive Nissan.

His detention has thrown into doubt the long run of the Alliance – a world carmaking team that comes with Renault, Nissan and Mitsubishi.

It has additionally uncovered fractures within the very close relationship between Renault and Nissan

1. The Alliance – three companies performing as a unmarried entity

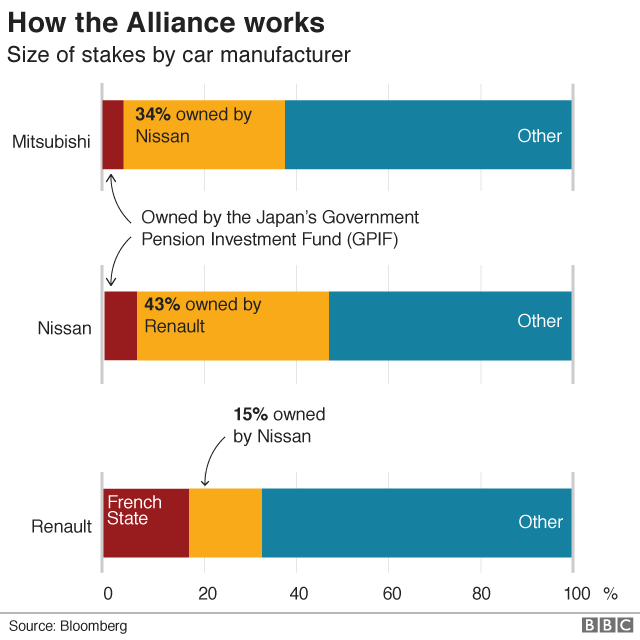

The Alliance was once shaped in 1999, while Renault rescued Nissan from the brink of bankruptcy. The French carmaker has a 43% stake in its Japanese partner, at the same time as Nissan has a fifteen% stake in Renault.

Today, even if the three corporations continue distinct identities, they act as a global automobile grouping. They increase and use commonplace applied sciences, buy parts from the same suppliers, and are creating programs for development cars from commonplace “modules”. Together they rent more than 450,000 folks, and sell more than 10 million cars a 12 months.

Before this scandal erupted, Carlos Ghosn was once chairman of both Nissan and Mitsubishi, as well as being chairman and chief govt of Renault. He was and continues to be chairman and chief executive of the Alliance, which has its own board.

2. Nissan has grown faster than its partner

Although the 3 Alliance companies already have very shut links, Carlos Ghosn had plans to bring them closer, and in particular to strengthen the already strong links between Renault and Nissan.

The BBC knows that at the same time as this will likely have fallen wanting a whole merger, with each companies keeping up their separate company identities, it would well have concerned Renault taking a majority stake in its partner.

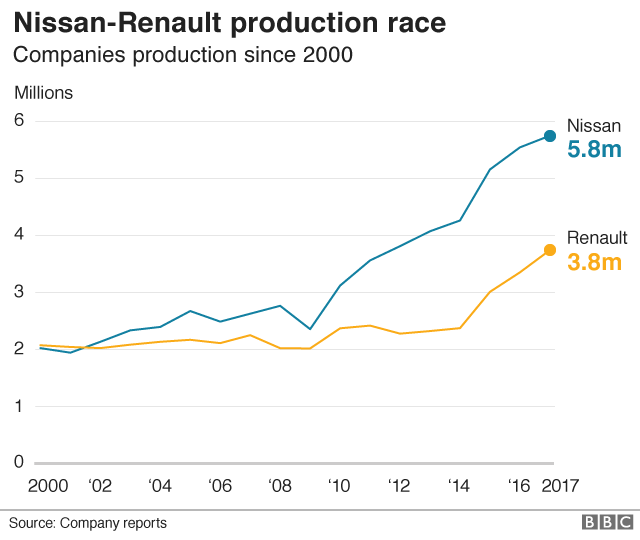

This is thought to have caused worry and resentment at Nissan – and looking out on the graph underneath, it’s simple to see why. When the partnership among the two used to be first based, they have been building vehicles at an analogous rate.

When You Consider That then, Renault has just about doubled its output, helped partly by the purchase of the Russian manufacturer Avtovaz in 2014.

But Nissan has grown even more briefly. It now makes just about 6 million vehicles and light trucks annually – kind of a 3rd more than Renault. Final yr it made a profit of $5.8bn, and accounted for a large chunk of Renault’s personal income.

So noticed from that perspective, Nissan and its executives may well be forgiven for asking why they risked dropping standing and affect within the Alliance, regardless of offering the lion’s share of production and earnings.

3. The Ghosn effect

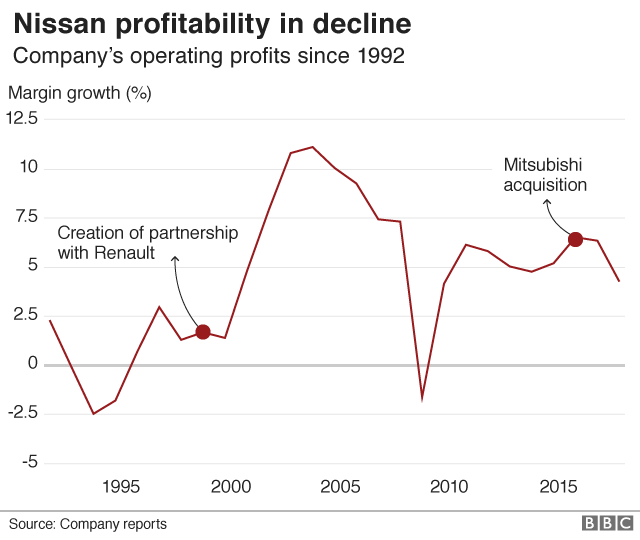

That stated, Carlos Ghosn can justifiably declare a perfect deal of credit for Nissan’s current energy. When he joined the company in 1999, he already loved the nickname “le Price Killer” in France for his movements at Renault.

He brought an identical ruthlessness to Nissan, final factories, chopping jobs and remodeling the best way it operated. as the chart underneath presentations it was an effective strategy. Working earnings soared and remained high until the monetary predicament, while like other producers Nissan noticed its income plummet.

Nissan recovered from the drawback quickly but seeing that then the street has been rockier. In up to date years, its margins had been hit by way of declining sales, emerging prices, and a top quality keep an eye on scandal in Japan. in the six months to the tip of October, operating profit was down through a quarter compared to last yr. So had Mr Ghosn already lost his Midas contact?

4. Mr Ghosn was smartly paid for his efforts

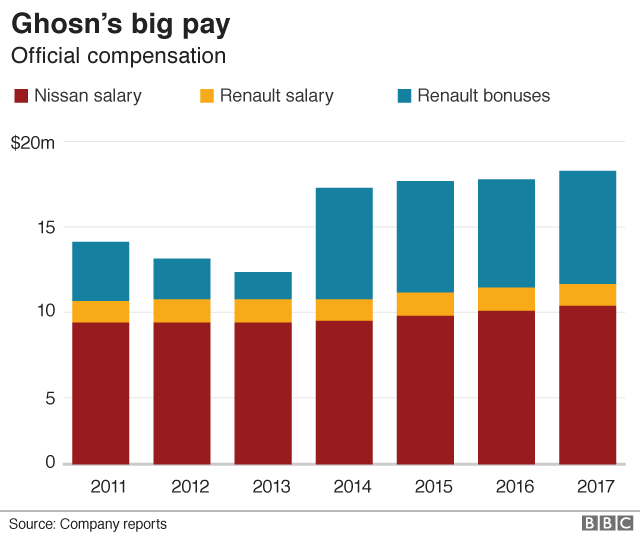

Nissan claims that Mr Ghosn were systematically below-reporting his income to security regulators and have been misusing company property for private get advantages. Those allegations are being studied via prosecutors, even as Mr Ghosn himself remains in custody.

There are many vibrant tales about what precisely he is alleged to have done circulating within the japanese media, even if there has been no response so far from Mr Ghosn or his legal professionals.

But one thing we will be certain that of is that, beneath-reported or no longer, he used to be earning a number of cash. Closing 12 months he used to be paid approximately $17m in salary, share choices and bonuses.

In truth there has been numerous controversy about his pay packet in the prior, however mainly in France, where it has been the topic of an annual showdown with shareholders. Those shareholders come with the French state, which voted in opposition to his recent package in June.

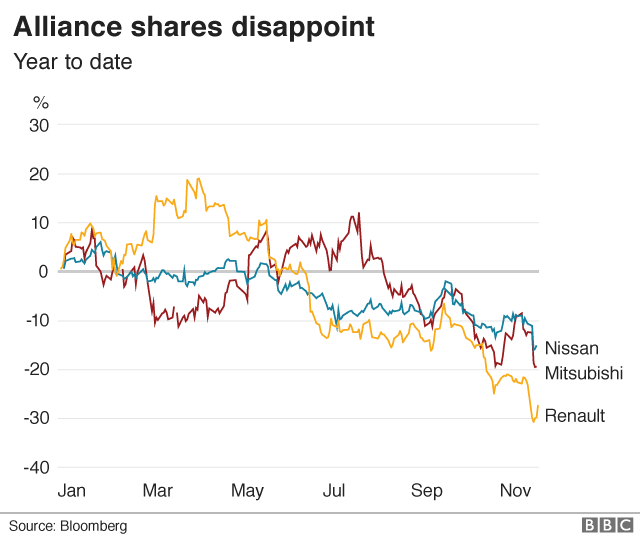

FIVE. Shares were lagging

It hasn’t been a perfect year for investors in the Alliance firms. Renault’s stock did surge briefly in the early part of the yr, first on reviews of a potential merger with Nissan and then amid speculation the French executive could promote its stake to the japanese producer. However in up to date weeks all three were within the doldrums.

That Is in part to do with the state of the market globally. but it surely may also replicate uncertainty approximately the future of the Alliance – and Mr Ghosn’s role in it – which used to be apparent neatly prior to the inside track about Mr Ghosn erupted.

That information precipitated steep falls in all 3 corporations’ inventory. If the long run was unsure ahead of, it is even more so now.