Symbol copyright Reuters Symbol caption Monetary markets are uneasy approximately President Erdogan’s perspectives on economic coverage

Symbol copyright Reuters Symbol caption Monetary markets are uneasy approximately President Erdogan’s perspectives on economic coverage

Is Turkey heading for an economic and monetary drawback?

Contemporary traits within the country’s financial markets have definitely been alarming.

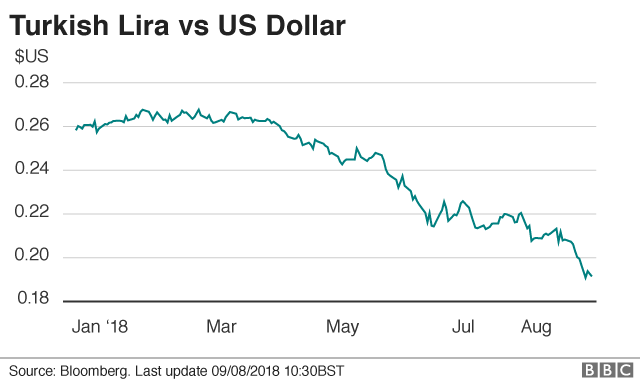

The Turkish currency, the lira, has misplaced approximately 30% of its price towards the us buck for the reason that New Year.

The inventory market has fallen 17%, or in the event you degree it in bucks as some overseas traders would do, the decline is FORTY%

Another measure incessantly watched within the markets is executive borrowing costs.

The important financial institution has an inflation aim of five%. A year in the past, inflation used to be well above that, at about 10%. Given That then the placement has deteriorated additional with prices now emerging at an annual fee of about 15%.

Monetary marketplace buyers also are very uneasy about President Erdogan’s perspectives on economic coverage and the force he is noticed as exerting at the country’s central bank.

there’s an glaring coverage choice open to a crucial financial institution that wants to endure down on inflation – raising interest rates.

That can lower inflation in two ways. it may possibly weaken demand at house, and by way of expanding financial returns in Turkey encourage traders to buy lira – which strengthens the foreign money and decreases the cost of imports.

Turkey’s significant financial institution has taken a couple of such moves, however with none lasting have an effect on at the problem.

US family members

What bothers the markets is the president’s well known – and most economists may say, ill-knowledgeable – competition to better charges. He has defined himself because the enemy of rates of interest.

The result’s that traders are not yes that the significant bank will do what is had to stabilise the currency and bring inflation beneath keep an eye on. In turn, that makes them more cautious about the outlook for Turkish financial property.

Confidence has been further undermined via Turkey’s strained relations with the United States.

Turkey has detained an American evangelical pastor and there are variations over the way to Syria. in addition, the united states is reviewing Turkey’s eligibility for a programme that gives many exports from developing international locations accountability-unfastened get admission to to the u.s. market.

Turkey is also in peril from trends in the US. The Federal Reserve keeps to boost interest rates, which encourages buyers to drag money out of rising markets. The have an effect on has been average, however it is potential tense issue for international locations similar to Turkey with different vulnerabilities.

Symbol copyright EPA

Symbol copyright EPA

In a few respects the hot efficiency of the Turkish economic system seems reasonable. It has grown once a year this century except for 2001 (the country’s remaining financial obstacle when it received an IMF bailout) and 2009 (in the aftermath of the worldwide financial obstacle). In some years growth has been very sturdy.

Unemployment is on the high side – the most latest figure is 9.9% – however it has been rather stable.

One important distinction when compared with the country’s obstacle on the beginning of the century is that there’s now no change fee goal, not like in 2001.

Back then, the force in the foreign money markets pressured Turkey to desert the targets. This time there’s no forex peg so the lira has merely been allowed to depreciate.

That stated, credit standing agency Moody’s says that economic enlargement has been boosted to unsustainable ranges by spending and tax insurance policies. Insurance Policies for long-term growth have been sidelined, the company says, given the point of interest on election cycles.

Fitch warns that the risk of a difficult landing for the economy, meaning a sharp slowdown or even a recession, has increased.