Symbol copyright Getty Photographs Image caption Luxury yachts off the Lycian coast in southern Turkey

Symbol copyright Getty Photographs Image caption Luxury yachts off the Lycian coast in southern Turkey

Turkey’s currency, the lira, has hit report lows, making a headache for the country’s president and pushing up costs on on a regular basis items.

However there may be one space reaping the advantages: tourism. Bookings to Turkey have gone up in recent months – even if the exact result in is, in fact, hard to say.

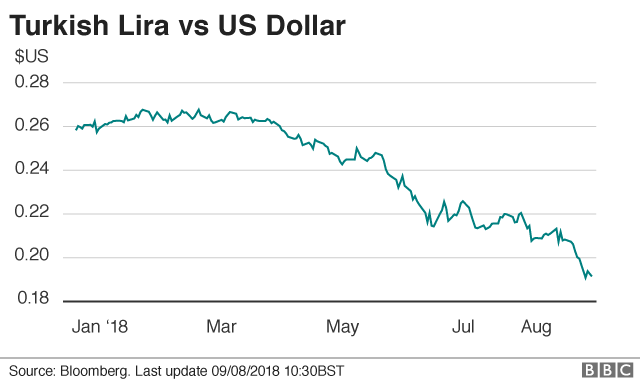

A beneficial exchange fee regardless that cannot have harmed the location: on Friday, the united states greenback might buy virtually six Turkish lira; at the finish of January, it would have gotten you lower than four.

So what has happened to send the lira on a downward spiral and will extra tourists take advantage?

What’s came about?

the value of Turkey’s foreign money has nosedived in view that January and has lost greater than 34% of its value in opposition to the greenback.

The inventory market has additionally fallen 17%, while government borrowing costs have risen to 18% a yr, in line with Andrew Walker, the BBC World Service economics correspondent.

Meanwhile, inflation in Turkey has hit 15%.

What led to this nosedive?

a mix of factors, in line with professionals, have resulted in fears the country is sliding into an financial challenge.

For a get started, traders are worried that Turkish companies that borrowed closely to profit from a development growth might battle to pay off loans in greenbacks and euros, as the weakened lira method there’s now more to pay back.

Then there are Turkey’s worsening family members with the us. Donald Trump’s management hit its justice and interior ministers with sanctions final week, a reaction to the detention of yankee pastor Andrew Brunson, who has has been held for almost years over alleged links to political groups.

the us dealt Turkey and the lira an extra blow in a tweet on Friday, through which Mr Trump mentioned he had licensed the doubling of tariffs on Turkish steel and aluminium.

Image copyright Reuters Symbol caption The Celsius Library within the Aegean region

Image copyright Reuters Symbol caption The Celsius Library within the Aegean region

Nafez Zouk, an economist at Oxford Economics, instructed the BBC’s As Of Late programme earlier this week that those problems have been further compounded through a “political set-up that’s unconducive to right kind financial control”.

Indeed, a lot of the recent concern has been fuelled through President Recep Tayyip Erdogan’s financial policy.

In many nations, including the united states and ECU states, the important financial institution is independent of government and no person can inform it what to do with interest rates. this implies it may possibly stay control of inflation by means of elevating them when necessary.

Is Turkey heading for an economic difficulty? US hits Turkey with sanctions over jailed pastor How powerful will President Erdogan be?

But in Turkey, Mr Erdogan has made certain he controls the reins. Early final month, he claimed the exclusive power to nominate the bankers that set rates of interest – and to cement his keep watch over he has put his son-in-legislation to blame of monetary policy.

And if he’s flustered by the present state of affairs, he’s not showing it. On Thursday, he recommended supporters not to fear, pronouncing that whilst out of the country buyers had greenbacks, Turks had Allah.

Can its fall be stopped?

If the right insurance policies have been applied.

But whilst Mr Erdogan – who vowed Turkey may win the “economic conflict” – favours lowering borrowing costs to fuel credit score growth and financial expansion, others might slightly see interest rates rise.

Image copyright Getty Photographs Symbol caption A view over the vintage the town of Kaleici, Antalya

Image copyright Getty Photographs Symbol caption A view over the vintage the town of Kaleici, Antalya

But Mr Erdogan is famously averse to interest rate rises, and there are fears he is also pressuring the valuable financial institution not to act.

Meanwhile, ING economist Carsten Brzeski advised information company Reuters “some more or less… involvement” by way of the International Financial Fund (IMF) used to be “getting nearer”.

Solving Turkey’s tensions with the united states might also most probably move a way to quell nerves. Alternatively, the Monetary Instances points to analysts who recommend Turkey will most probably just wait it out.

So, is now the time to go to Turkey?

Neatly, if you happen to want azure seas, historical temples and a vacation which perhaps prices lower than it did ultimate yr, then yes.

Eagle-eyed Brits have already figured this out, it sort of feels, with trip dealers reporting a rise in bookings.

Image copyright AFP Symbol caption A view across Istanbul

Image copyright AFP Symbol caption A view across Istanbul

Vacation company Thomas Prepare Dinner has observed a SIXTY THREE% upward thrust in bookings to Turkey, even as TUI stated it was their 3rd hottest vacation spot which means it used to be “well and actually again on the map as a best summer time holiday region”.

Alternatively, the united kingdom International Administrative Center nonetheless recommends against all but very important commute to a host of areas, mainly alongside the border with Syria, and says not to shuttle inside of 10km (six miles) of the border in any respect, because of the continuing Syrian war.

the u.s., meanwhile, rates Turkey at level three, urging other folks to reconsider go back and forth to the region.