Symbol copyright Getty Pictures

Symbol copyright Getty Pictures

The U.s. is threatening to enhance its industry battle with China.

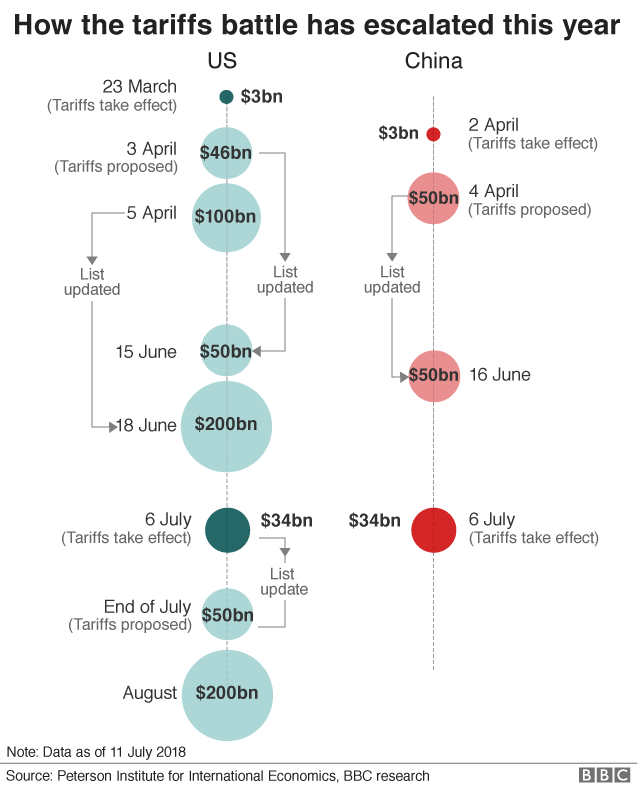

It imposed tariffs on $34bn of Chinese items on 6 July and handiest days later indexed another $200bn of additional merchandise it intends to target.

US President Donald Trump has stated more than $500bn worth may well be hit – almost all the price of China’s goods exports to the us remaining 12 months.

The U.s. buys nearly four instances as much from China because it sells to them. for the reason that China has restricted room to retaliate via trade, it would are trying to find other ways to get back at the united states.

1. Action against US companies

US corporations generate approximately $300bn of sales locally in China in order that they are a potential goal, says Julian Evans-Pritchard from Capital Economics. He highlights the likes of Apple, that have important gross sales and operations there.

THREE. Devalue the currency

Lowering the price of the yuan may lend a hand exports by making Chinese goods inexpensive for other nations to import, and could offset the rise in prices resulting from the united states price lists.

Analysts say the fact China’s vital bank has no longer supported the forex all through its up to date fall presentations they’re leaving things to market forces for now.

Given the yuan has fallen to a one-year low towards the dollar, analysts also see little need for the primary financial institution to intrude at this time.

“there is clearly a few willingness to allow the foreign money to weaken to hose down the impact of the tariffs,” Mr Evans-Pritchard says. “I Don’t expect them to engineer a major devaluation of the foreign money.”

FOUR. Promote US bonds

China owns greater than $1tn folks govt bonds, which some concern offers Beijing influence over the united states financial system.

But if China bought US bonds in bulk, it could harm China. Why? Because that may cut back the price of an asset China holds a lot of, and it could must transfer to different, much less liquid overseas bond markets.

Also the affect on the us is likely to be limited, as US debt sold via China is likely to be bought via different international locations.

“we expect this is most unlikely, as falling costs of us treasury securities could even be a loss for China,” Nomura mentioned in a analysis be aware. “in addition, we imagine it could be very tricky for China to re-invest its US buck holdings in a wise means after selling US treasuries.”

Image copyright Getty Photographs

Image copyright Getty Photographs

5. Intervene with North Korea talks

Mr Trump has steered China may be interfering in US efforts to denuclearise North Korea.

He recently tweeted he had trust that North Korean chief Kim Jong Un might honour their settlement, however brought: “China, at the different hand, may be exerting negative drive on a deal on account of our posture on Chinese Business-Desire Not!”.

i have confidence that Kim Jong Un will honor the agreement we signed &, even more importantly, our handshake. We agreed to the denuclearization of North Korea. China, on the different hand, may be exerting terrible drive on a deal because of our posture on Chinese Business-Hope Not!

— Donald J. Trump (@realDonaldTrump) July NINE, 2018

End of Twitter put up by means of @realDonaldTrump

PIIE lately wrote that China had “formidable” guns in a trade conflict and could use leverage in areas outdoor the industrial sphere.

“that is a card China may just easily play – just sign to the North Koreans to do what comes evidently – stall,” PIIE’s Mr Hufbauer says. “The Massive downside is that such motion escalates the industry dispute into a geopolitical dispute of unknown magnitude.”

6. Center Of Attention at the domestic economic system

China could take care of household expansion, by means of ensuring it has the gear to maintain the economic system rising right through more difficult instances and by means of increasing its trade and investment family members with other nations.

Mr Evans-Pritchard says China’s “most suitable option” in responding to price lists is to be able to prop up the economic system. He notes there are signs that in advance movements to sluggish credit growth and rein in debt ranges are converting already.

HSBC’s Julia Wang says China will attempt to make bigger business with nations instead of the us. China just lately hosted EU officers and discussed loose business.

“i think China has already been looking to diversify its industry and funding dating away from the us since a few years in the past, and now they are going to unquestionably boost up,” she introduced.