Image copyright Getty Photographs Image caption The Trump administration says protective US steel and aluminium producers is a matter of nationwide safety

Image copyright Getty Photographs Image caption The Trump administration says protective US steel and aluminium producers is a matter of nationwide safety

The G20 team of finance ministers have said industry tensions may undermine the global economy.

They called for higher discussion to reduce the risk after a nerve-racking, -day assembly in Argentina.

The summit comes because the US ramped up business tensions on Friday, announcing it was able to slap price lists on all $500bn of imports from China.

France’s finance minister, meanwhile, said the eu won’t negotiate industry with “a gun to its head.”

In a joint remark, the G20 ministers mentioned dangers to expansion “over the fast and medium time period have higher. Those come with rising monetary vulnerabilities, heightened business and geopolitical tensions.”

Symbol copyright Reuters Image caption Companions or foes? Steven Mnuchin (left) and Bruno Le Maire at the G20 assembly in Buenos Aires

Symbol copyright Reuters Image caption Companions or foes? Steven Mnuchin (left) and Bruno Le Maire at the G20 assembly in Buenos Aires

“The legislation of the fittest – this cannot be the future of global business members of the family. The legislation of the jungle will only end up losers, it is going to weaken growth, threaten the most fragile nations and feature disastrous political consequences.”

He introduced that a business warfare was once now a truth, and that the european could not imagine negotiating a unfastened business deal with the us without The Us first taking flight its tariffs on metal and aluminium.

What is the united states argument?

Mr Mnuchin stated it was lovely simple.

“My message is pretty clear, it is the same message the president introduced at the G7 (remaining month in Canada): if Europe believes in unfastened business, we are ready to signal a free industry agreement without a tariffs, no non-tariff obstacles and no subsidies. It has to be all 3,” he said.

Mr Mnuchin stated China had to open its markets “so we will be able to compete moderately”.

Tariff war. How did we get right here?

Little has caused Donald Trump extra annoyance than the trading deficits between the us and its leading partners.

He believes that should you have a business deficit – in case you import greater than you export – you are shedding out.

Tackling what he has known as “unfair buying and selling practices” has change into a key plank of his administration.

The Ecu Union, China and the North American Free Industry Settlement (Nafta) countries, Mexico and Canada, were his main targets.

Mr Trump has pulled out of the Trans-Pacific Partnership (TPP) business deal and needs a renegotiated Nafta deal.

US price lists a dangerous sport, says ECU

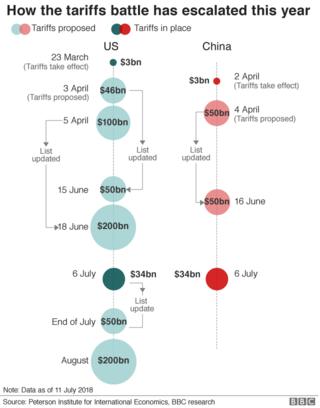

The key movements so far

January: the united states slaps price lists on imported washing machines and sun panels

June: The Trump administration introduces tariffs of 25% on metal and 10% on aluminium imported into the us, arguing that international oversupply, driven by way of China, threatens American producers. the ecu enacts retaliatory tariffs on a range folks items, together with bourbon whiskey, Harley Davidson motorcycles and orange juice

July: A 25% tariff affecting $34bn (£25.7bn) of Chinese items starts. China retaliates in kind, with similar tariffs on the similar price folks items. Mr Trump threatens a ten% additional tariff on $200bn worth of additional Chinese products, naming greater than 6,000 items

Full checklist of us items hit via new EUROPEAN import tariffs  Image copyright Getty Photographs

Image copyright Getty Photographs