Image copyright Getty Images

Image copyright Getty Images

US vital bankers have raised a key interest rate again this week, lifting the bank’s benchmark fee to its very best stage for the reason that 2008.

The US Federal Reserve raised the objective federal budget rate through 0.25%, taking it to 1.75% to two%.

The upward push marks the Fed’s 7th rate increase on account that 2015.

Officials purpose to head off excessive inflation with higher charges and think the us economy can maintain upper borrowing prices.

They also are shrinking the Fed’s large holdings of government debt and mortgage-sponsored securities, which have been purchased to boost the economy out of the recession that ran from overdue 2007 to 2009.

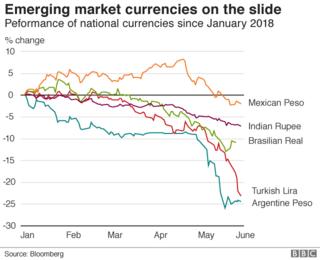

The retreat from emerging markets continues to be fairly modest, with weekly flows to bond and equity funds down less than 10% from their peaks, consistent with EPFR World, a part of analysis firm Informa.

but it has coincided with – and partially fuelled – a better buck, contributing to foreign money crises in international locations equivalent to Argentina, Turkey and Brazil.

It has additionally prompted important banks elsewhere, including in Indonesia, Malaysia and Hong Kong, to raise their very own interest rates in defence.

Argentina increases interest rates to FORTY% Turkey’s fragile economy worries electorate ahead of election US rate rise: Should Asia fear?

International Locations that experience noticed the worst market turmoil have additionally faced political and fiscal issues of their own.

However the Fed may be underestimating its role, mentioned Desmond Lachman, a fellow at the American Undertaking Institute and former head of emerging market technique Salomon Smith Barney.

He pointed to latest remarks by Federal Reserve Chair Jay Powell that the facility folks rates of interest is “regularly exaggerated”.

If the turbulence persists, it might harm economies in another country, ultimately lowering demand for US products and services, he brought.

“Fed tightening is causing every kind of issues for plenty of rising market nations and people problems can then come back to impact the united states,” he said. The Fed “need to be fascinated with it, but i don’t know the way a lot it’s”.

Image copyright Reuters Image caption Jerome Powell says the role of the Federal Reserve is generally exaggerated

Image copyright Reuters Image caption Jerome Powell says the role of the Federal Reserve is generally exaggerated

Client caution

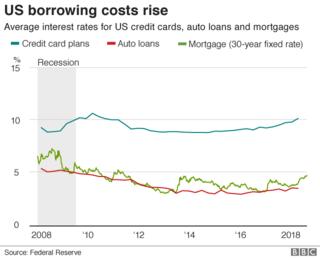

In the us, banks are passing on higher borrowing costs to customers, raising the rates they price for items comparable to bank cards, mortgages and automobile loans.

Client spending – a tremendous motive force of the united states financial system – has held up, as a powerful economic system gives other people confidence they can shoulder the brought cost.

But with US earning still slightly flat, upper charges could in the end set off larger warning.

Indicators of pressure are already visible in parts of the economy dependent on borrowing, just like the housing marketplace, the place the pace of home gross sales has weakened, amid low provide and prime prices.

A robust process market has helped to limit the effects, but economists say fee rises can cause buyers to retreat, despite the fact that reasonable mortgage charges – which crowned 4.5% this spring – stay a couple of points lower than sooner than the financial main issue.

US financial system grows at a slower 2.2% Client worth upward push signs firming inflation

Fed officials are smartly aware salary expansion has been sluggish, of course. they sometimes cite it as a reason to be careful about elevating charges.

But they want to stop dramatic worth inflation, which many economists be expecting to boost up after the u.s. handed an important tax lower closing year.

Bank windfall

Higher rates of interest should be a boon to savers, who stand to earn extra on the cash they have got squirreled away in bank bills.

But US banks by and massive have been sluggish to boost the interest paid on financial savings and different accounts.

Banks offered a standard interest rate of 0.15% for a normal savings account in March 2018, up just 0.03 percentage points from three years past, according to data from the National Credit Score Union Administration.

Thus Far, the paltry rates have helped to boost bank income, without costing them debts.

But analysts say shoppers will search for better phrases in the event that they see inflation start to devour away at their stockpiles.

Data means that inflation, which has lagged the Fed’s aim 2% price in latest years, is also beginning to pick up, so banks can have to start out moving if they want to maintain deposits.